Research Note

Making America Great Again

Shimshon Bichler and Jonathan Nitzan [1]

Jerusalem and Montreal, September 24, 2019

![]() bnarchives.net / Creative Commons (CC BY-NC-ND 4.0)

bnarchives.net / Creative Commons (CC BY-NC-ND 4.0)

1. ‘Leaders’ and ‘Policymakers’

Trump has promised to ‘make America great again’. As a self-proclaimed expert on everything of import (see video clip), he knows exactly how to increase domestic investment and consumption, boost exports, reduce the country’s trade deficit, expand employment and bolster wages. And as America’s leader-and-policymaker-in-chief, he has taken the necessary steps to achieve every one of these goals. He has lowered taxes on corporations and the rich to induce greater investment, relaxed environmental standards and de-socialized medical care to cut red tape and eliminate waste, curtailed civilian government spending and raised military expenditures to make government lean and mean, warned corporations and individuals to remain economically patriotic and undermined the Fed’s ‘independence’ to prevent interest rates from rising and the stock market from tanking. And if that wasn’t enough, he has also launched a so-called trade war to prevent America from being ripped off by other countries, especially China.

Capitalists and pundits follow him like imprinted ducks. His tweets rattle markets, his announcements are dissected by academics and his utterances are analysed to exhaustion by various media. A visiting alien might infer that he actually runs the world.

And the alien wouldn’t be alone. The earthly population too, conditioned by ivory-tower academics and popular opinion makers, tends to think of political figureheads as ‘leaders’ and ‘policymakers’. Situated at the ‘commanding heights’ of their respective nation states and international organizations, these ‘leaders’ supposedly set the rules, make policies, steer their societies and determine the course of history. Or at least that’s the belief.

The reality, though, is quite different. The relentless spread of the capitalist mode of power has long robbed formal politics of its past glory. Contrary to the conventional creed, political figureheads nowadays have little leverage and almost no autonomy. They have become predicable subjects, glorified media pawns whose bureaucratic position subjugates them to a systemic logic they rarely understand but duly obey. Even erratic, ‘self-made-know-it-all’ characters like Trump cannot veer too far from the capitalized script – lest they be reprimanded or simply purged in a capitalist backlash.

Note that our point here is not that formal politics cannot change the world, but that it cannot do so without significantly transforming the capitalist mode of power in which it is embedded. And such a transformation is something that most present-day politicians cannot even contemplate, let alone achieve.

2. Differential Profit

Begin with profit. According to former U.S. President Calvin Coolidge, ‘the chief business of the American people is business’. His proposition, made in 1925, has since become the ideology and praxis of nearly all nation states on earth. And given that business is ultimately about profit, the ‘greatness’ of a country must be judged by its differential profit – in this case, the profit its capitalists earn relative to those earned by capitalists in other countries.

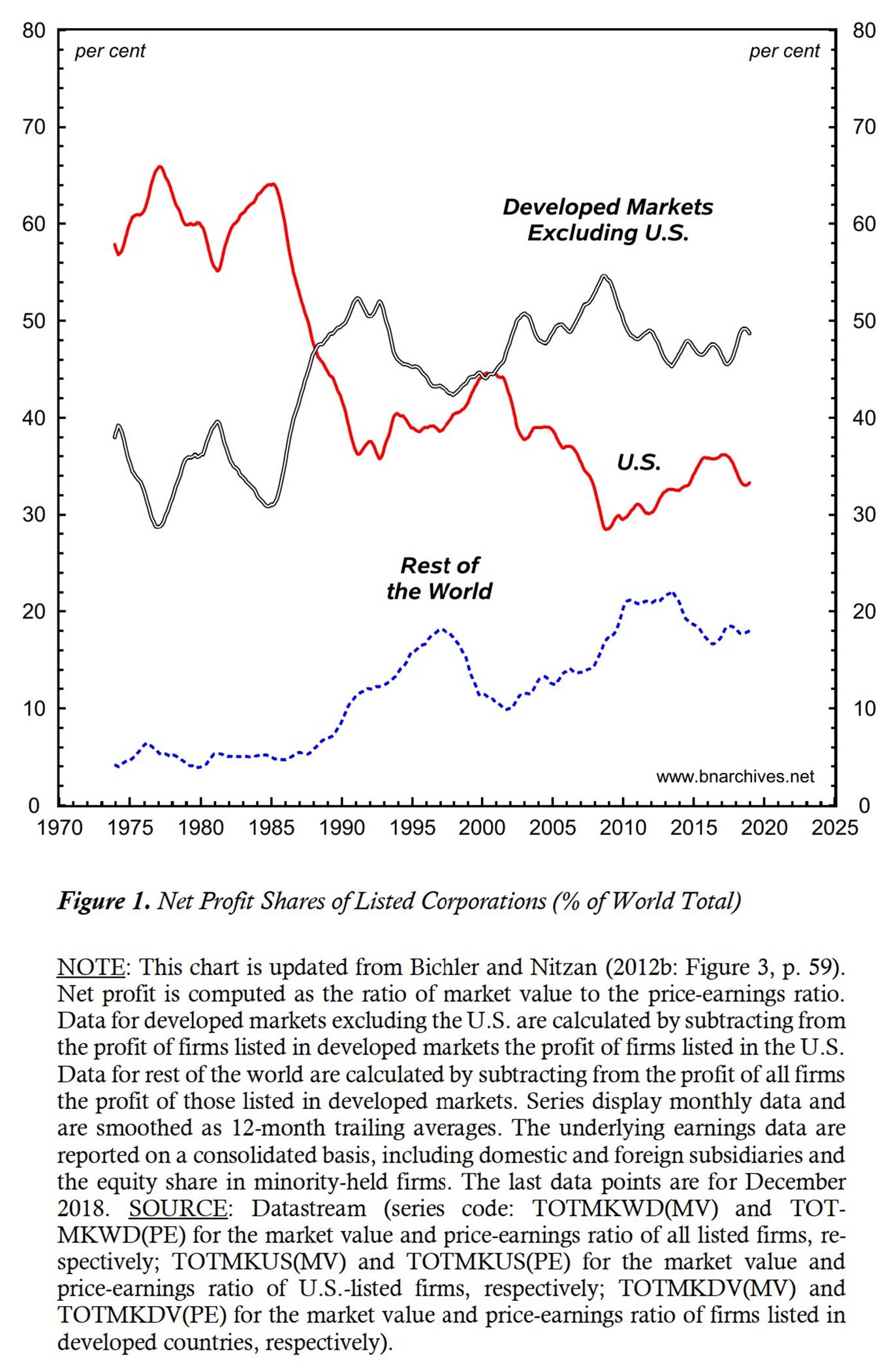

Figure 1 offers a historical overview of this differential, showing the global distribution of net corporate profit between firms listed in (1) the United States, (2) developed markets excluding the United States and (3) the rest of the world.

During the 1970s and early 1980s, U.S. corporate owners still reigned supreme, earning over 60 per cent of all net profit recorded by listed firms around the world. But with the ascent of other developed markets in the late 1980s and the rise of emerging markets since the early 1990s, U.S. differential earnings dropped sharply, falling to 30 to 35 per cent of the total in recent years (as a side note, notice the embarrassing 2016-18 downtick during the Trump presidency).

Judging by this chart, and assuming that a country’s ‘greatness’ indeed equals its differential business success, it’s clear that America is no longer great – or at least not as great as it once was.

3. The Exchange Rate

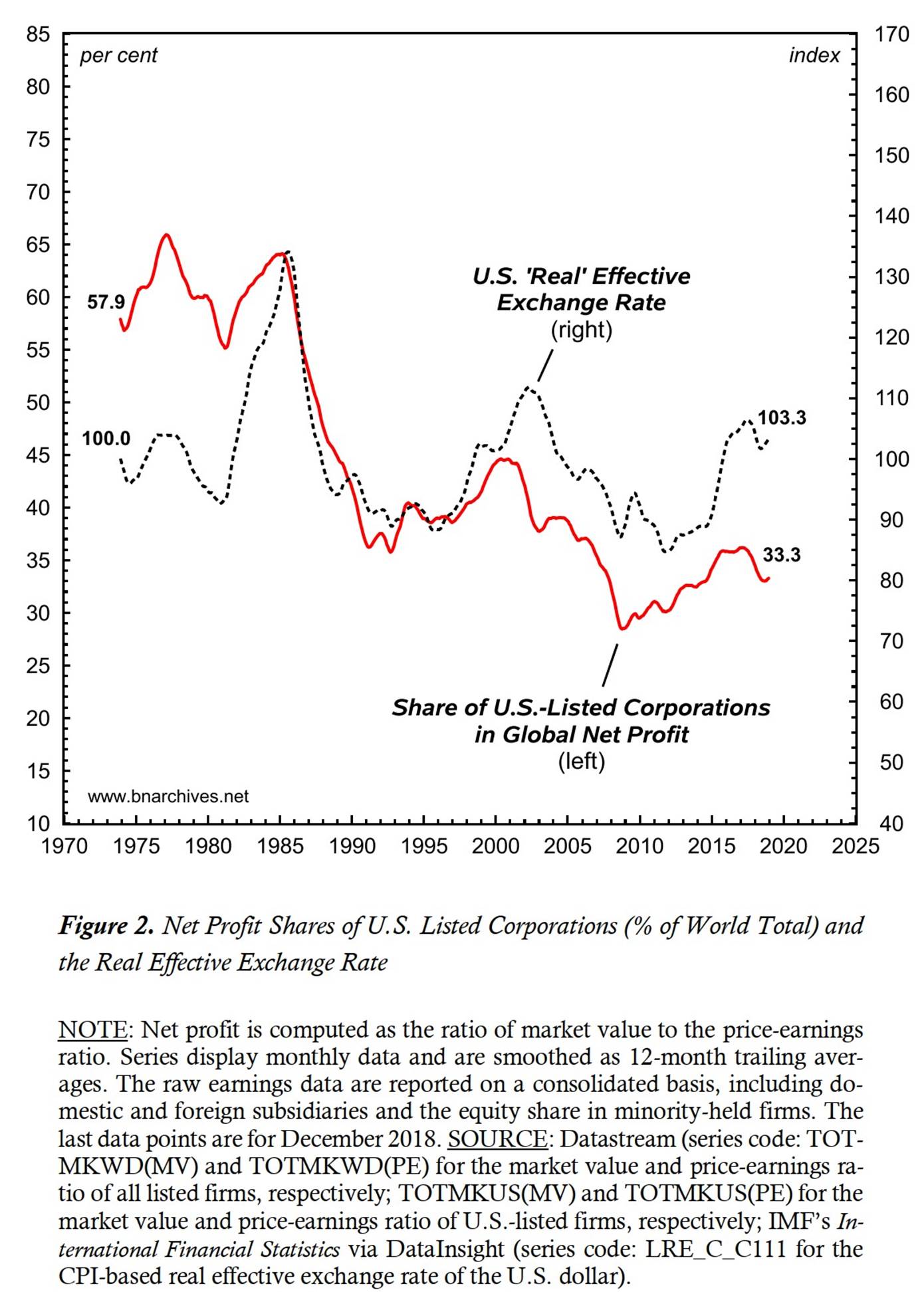

Could this fall from grace be blamed on the weakening dollar (Francis, Bichler, and Nitzan 2009-2010)? After all, when the U.S.’s ‘real’ effective exchange rate depreciates – in other words, when the dollar’s value falls relative to a basket of traded currencies adjusted for their respective consumer prices – non-U.S. firms charge relatively higher prices than U.S. firms do and/or convert their local-currency earnings to more U.S. dollars, thus causing the U.S. share of global profit to fall – and vice versa when the ‘real’ effective exchange rate appreciates (the ‘real’ effective exchange rate of a country depreciates/appreciates with a fall/rise in its nominal exchange rate, as well as when domestic prices decline/increase relative to foreign ones).

Figure 2 shows this impact by contrasting the global profit share of U.S.-listed firms on the right-hand scale with their country’s ‘real’ effective exchange rate on the left, and according to the chart the two series indeed correlate positively. But the correlation is entirely cyclical. The long-term trends are not correlated at all: during the past half-century, the exchange rate moved sideways (starting at 100 in 1973 and ending at 103 in 2018), while the global profit share dropped perceptibly (beginning at 57.9 per cent in 1973 and ending at 33.3 per cent in 2018). In other words, America’s fall from business grace can hardly be blamed on its currency.

4. Going Public

Another possible culprit for the falling U.S. profit share has to do with the rapid public listing of non-U.S. firms (Francis, Bichler, and Nitzan 2009-2010). Note that the underlying profit series in Figures 1 and 2 pertain to listed (i.e. publicly traded) firms only; they do not include the earnings of unlisted (private) firms. Now, until the onset of neoliberalism in the 1980s and the emerging-markets boom of the 1990s, many non-U.S. firms, including large ones, were unlisted, which means that their profit, however large, is excluded from our non-U.S. series here and therefore makes the U.S. profit share in that earlier period look bigger than it actually was. With the spread of neoliberalism, though, existing stock markets started to boom, new ones were established, and more and more non-U.S. firms began listing their shares for the first time. The tide of new listings converted privately held earnings to publicly traded profit, thus augmenting the aggregate profit of non-U.S. listed companies – but this augmentation, one might argue, is an accounting formality and should not be interpreted as a sign of U.S. decline.

On closer inspection, though, it is clear that what we are dealing with here involves more than mere accounting. Corporate listing makes the underlying assets – and therefore the power they represent – vendible, malleable, connectable and leverageable in ways that private unlisted assets can never be. And if this claim is correct, that means that the very listing of non-U.S. firms represents an increase in their power and therefore a comparable reduction in the differential stature of U.S.-listed firms.

5. Trojan Horses

And that’s not the end of it. As it turns out, many U.S.-listed corporations are not ‘American’ but ‘foreign’ (assuming this distinction is meaningful to start with). Note that the firms represented in Figures 2 and 3 are grouped based on where they are listed rather than where they are incorporated. In most countries, listed firms are almost always domestically incorporated, so this distinction is immaterial. But it certainly matters in global financial centres such as the United States, whose stock markets are home to many ‘Trojan horses’: locally listed firms that are incorporated elsewhere. And the crucial point for our purpose here is that the proportion of such firms has tended to rise in recent decades.

Based on the U.S. Compustat file, in 1950 foreign-incorporated firms accounted for only 4 per cent of the country’s top 500 listed corporations. But that number grew rapidly: it rose to 14 per cent of the total in 1980, 26 per cent in 1990, 41 per cent in 2000 and 48 per cent in 2010 (Bichler and Nitzan 2012a: 52). Other financial centres such as the United Kingdom and Hong Kong may have seen a similar increase, but because most of their Trojan horses are not U.S.-incorporated, this increase does not affect our argument here.

The net effect of this process is that the global profit share of ‘purely’ American firms – i.e., firms that are both listed and incorporated in the United States – probably declined faster than the share of all U.S.-listed firms (regardless of incorporation) as shown in Figures 2 and 3.

6. Breaking the National Envelope

All in all, then, the global decline of so-called American firms is real enough. And paradoxically, this decline is intimately related to a seemingly opposite process: the growing dependency of these very ‘American’ firms on foreign operations.

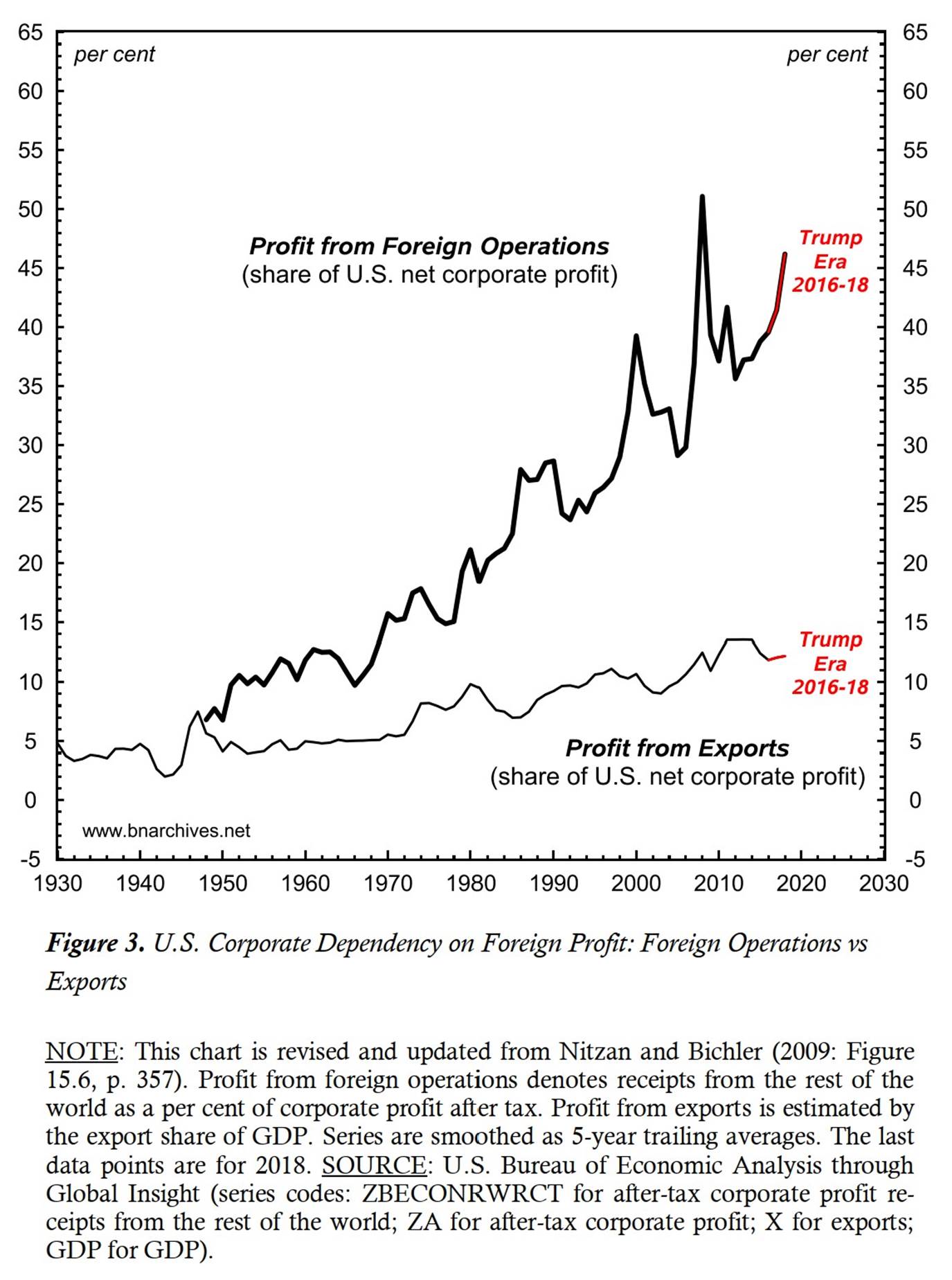

This latter process is shown in Figure 3. The top series measures the share of U.S. corporate profit coming from foreign subsidiaries, while the bottom series estimates the share earned from exports.

In the mid-1940s, both measures hovered around 7 per cent. The United States was still a relatively closed economy with an expanding population, rising ‘real’ wages and rapidly growing GDP per capita. In this context, U.S. firms looked mostly inward, earning over 85 per cent of their profit from domestic operations.

But the relentless drive of large firms to augment their capitalized power over the underlying population mandated ‘strategic sabotage’ in the form of rising unemployment and slowing growth (as examined in Nitzan and Bichler 2014 and illustrated in this 2019 video), while their the quest for differential accumulation relative to lesser firms set in motion a merger and acquisition uptrend that eventually made them ‘too big’ for the decelerating U.S. market (Nitzan 2001; Nitzan and Bichler 2009: Part V).

This differential power process, we argue, is key to understanding the exponential rise in the share of foreign corporate profit shown by the top series in Figure 3. Having exhausted the most lucrative takeover targets in their home country, and with their home country stagnating and therefore not generating new takeover targets at a fast enough rate, large U.S. firms have had no choice but to break the national envelope and go global. They started taking over foreign firms at an ever increasing rate (most FDI occurs via mergers and acquisitions rather than greenfield investment), and as the process accelerated the share of foreign profit rose dramatically. Foreign operations currently account for roughly half of all U.S. corporate profit, and if the uptrend persists the so-called American firm will soon become a misnomer.

7. Making America Great Again

Can Trump reverse or even dent this historical evisceration of ‘America’? The short answer is no. So far, his policies have only hastened this evisceration, accelerating the upward redistribution of income and amplifying the de-Americanization of U.S. corporations. During his three years in office, the share of foreign profit, instead of falling, has risen dramatically, moving toward a new all-time high (final red segment in the top series of Figure 3). Based on his record, it is no wonder that the U.S. ‘business community’, and particularly its leading firms, are firmly behind him.

The only hair in the soup is his so-called trade war against China. On the face of it, this ‘war’ looks like a flash-in-the-pan media stunt. China is unlikely to succumb in any meaningful way – and even if it does, exports are a sideshow for U.S. corporations (bottom series in Figure 3), so the overall impact on the global profit share of U.S. firms is likely to be marginal.

But international trade is not an isolated process. The ‘free’ (read corporate-determined) flow of commodities is the bedrock of ‘free’ (read corporate-determined) foreign investment, and if Trump’s trade war develops into a full-scale investment war, all bets will be off. At that point, and assuming he is still there, the maker of a great-again-America will likely be pressured to reverse course or lose the presidency.

Endnotes

[1] Shimshon Bichler and Jonathan Nitzan teach political economy at colleges and universities in Israel and Canada, respectively. All of their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net). Research for this paper was partly supported by the SSHRC.

References

Bichler, Shimshon, and Jonathan Nitzan. 2012a. The Asymptotes of Power. Real-World Economics Review (60, June): 18-53.

Bichler, Shimshon, and Jonathan Nitzan. 2012b. Imperialism and Financialism: The Story of a Nexus. Journal of Critical Globalization Studies (5, January): 42-78.

Francis, Joe, Shimshon Bichler, and Jonathan Nitzan. 2009-2010. Imperialism and Financialism: An Exchange. London, Jerusalem and Montreal.

Nitzan, Jonathan. 2001. Regimes of Differential Accumulation: Mergers, Stagflation and the Logic of Globalization. Review of International Political Economy 8 (2): 226-274.

Nitzan, Jonathan, and Shimshon Bichler. 2009. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Nitzan, Jonathan, and Shimshon Bichler. 2014. Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis. Review of Capital as Power 1 (1): 110-155.