[ Missed earlier parts of this series? Find Part 1 here and Part 2 here ]

Around the time of this post, SAG-AFTRA and the Alliance of Motion Picture and Television Producers (AMPTP) produced a tentative agreement in their 2023 negotiations. The SAG-AFTRA National Board approved the tentative agreement, and recommends for the ratification of the 2023 TV/Theatrical contracts. – J

When the profits stop, the danger zone hurts

Island of Lost Souls is the 1932 film adaptation of H. G. Welles’ The Island of Dr. Moreau. One of the film’s memorable scenes has Dr. Moreau, played by a very expressive Charles Laughton, making a public threat to a group of animal-human hybrids. Moreau cracks his whip in the air and states that any disobedience from his creations will have them spending more time in the “House of Pain”, which is Dr. Moreau’s operating room.

In labour negotiations, management does not have a literal House of Pain for its subordinates — unless our society travels further down the path of dystopia. Yet management can make grand threats in the same spirit of Dr. Moreau. When labour negotiations break down and strikes loom, a union is, in the eyes of management, disobeying. Troublesome unions have gone “too far” in their expectations for pay or safe working conditions. And because lots of people can be watching labour strife from the outside, management must, like Dr. Moreau to his audience of animal-hybrids, paint colorful pictures of bad outcomes. A striking union is making things worse for society. Economic pain will be felt by many. Pain will come from work stoppages, outsourced jobs, and lost trust.

In the cases of the recent WGA and SAG-AFTRA strikes, Disney CEO Bob Iger volunteered to speak on behalf of the Hollywood studios and express disappointment about the ways their writers and actors disrupted film and television production. Hollywood is still financially recovering from the COVID pandemic, says Iger, so workers had picked a inopportune time to ask for more. But is this not a misleading characterization of why writers and actors would have, from the perspective of the Hollywood studios, unrealistic expectations?

It is hardly surprising to find management attacking labour demands during a strike. This post explains why Iger and Hollywood CEOs are being disingenuous when they attempt to blame unions for deciding to be unrealistic at the worst possible times. So far, in this series of posts, we have found that strikes tend to occur in “danger zones”. We have also seen how Hollywood studios can be trapped by the prospect of rising risk. In this post we will learn why the pain of a strike in Hollywood comes from the whiplash of Hollywood’s use of stagflation, which is the combined effect of industrial stagnation — e.g., slow output, unemployment — and inflation. As stagflation is typically Hollywood’s solution to falling differential profits, demands of unions appear “unrealistic” by design, and almost automatically. Certainly any union can accept any contract that management offers; but when dominant firms prepare to slow employment and/or increase prices, it is counterproductive to the strategies of management to offer its employees a healthy contract that increases job security or offers better opportunities for profit sharing. Labour will have to fight for these gains.

Stagflation is the combined effect of stagnation and inflation. Mainstream economics recognizes these phenomena, but often in presentations about the macroeconomic effects of monetary and government policies. These macroeconomic effects are not necessarily irrelevant to stagflation, but this type of focus can produce misleading perspectives about the role of dominant firms in the driving of stagflation. Essentially, the focus on the macroeconomics of stagflation can carry assumptions about the inability of firms to do much in the winds of these broader economic forces. In terms of stagnation, we often assume that no firm would ever want such a condition, as productive growth is how economic value is created in society. In terms of inflation, the dominant narrative is still that firms react to waves of inflation, as they are price-takers, not price-makers.

For the readers following the news on investigations into “greedflation”, the massive profits of firms since the COVID pandemic have given alternative economic theories greater exposure. Since the start of my research on Hollywood in 2012, the capital-as-power approach has helped me sidestep many of the economic assumptions that ultimately produce misleading pictures of stagflation. If stagnation or price inflation are beyond the control of the Hollywood studios, we have a mindblowing coincidence: from the 1970s to the present, the differential profits of the Hollywood studios generally coincide with stagflation in the American motion picture industry. In other words, Hollywood tends to prefer states of slowed film production and rising prices.

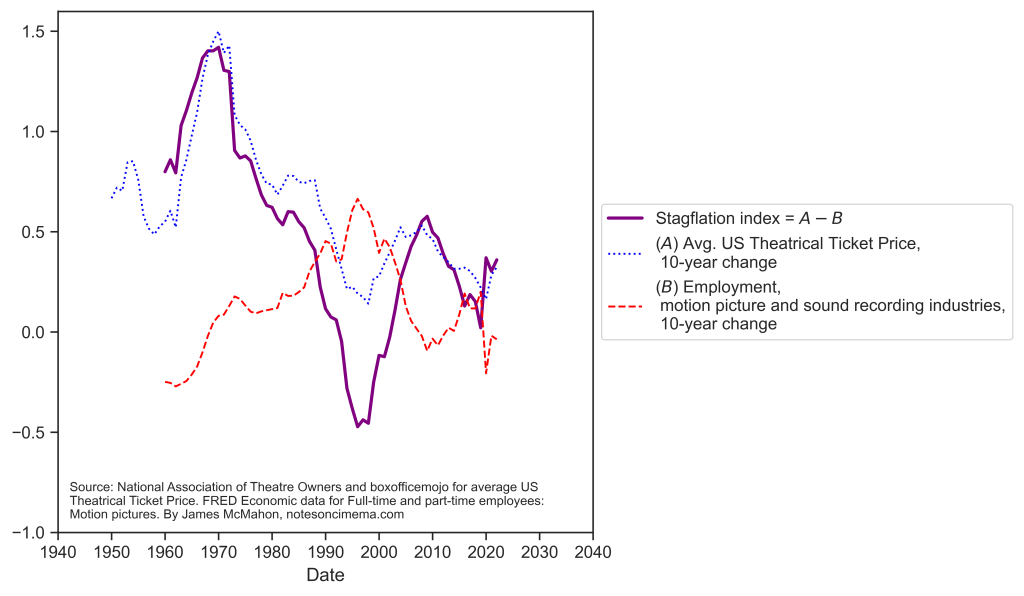

Figure 1 plots the history of stagflation in Hollywood from 1960 to 2022. The index of stagflation is the solid line in purple. It is a product of the other two series, which are the 10-year percent change of movie ticket prices and the 10-year percent change of employment in the United States motion picture and sound industries. Figure 1 shows a general historical decline of stagflation in Hollywood. The index rebounded and increased from 2000 to 2010. The index declined from 2010 to around the beginnings of the COVID pandemic.

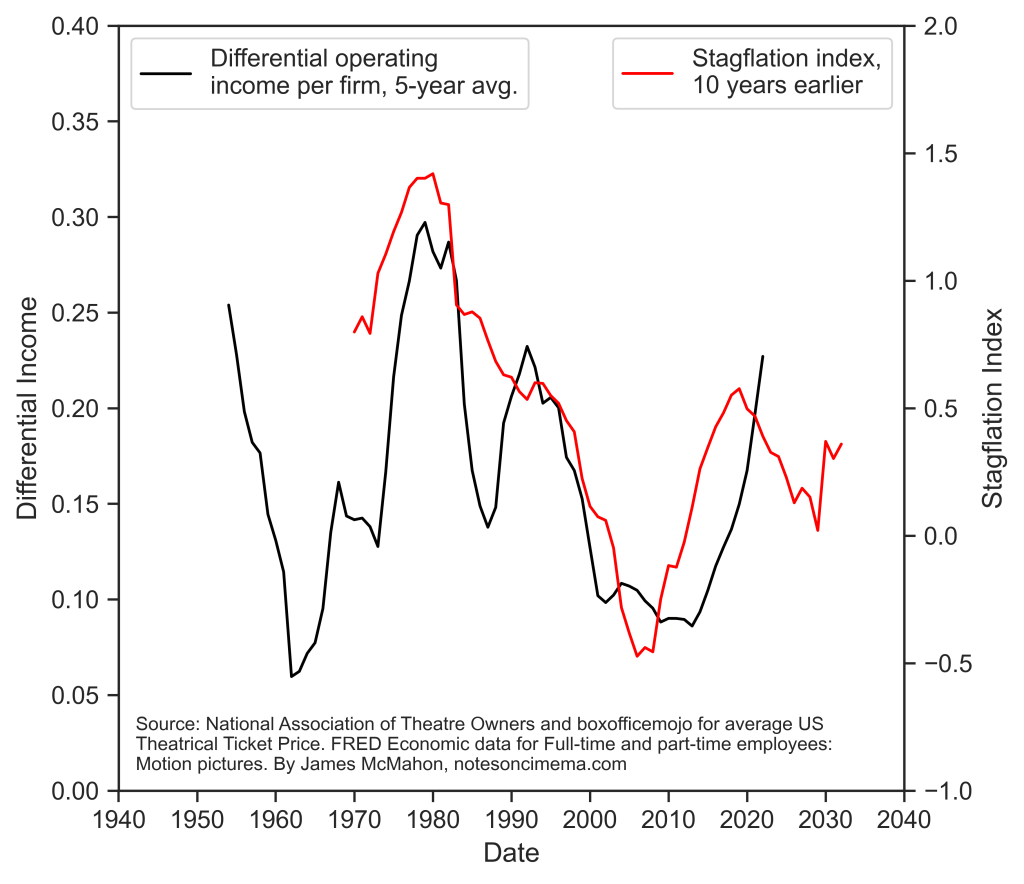

Figure 2 visualizes how stagflation is a leading effect of Hollywood’s differential profits. The figure plots the differential operating profits of the Hollywood studios and compares it to the index of stagflation, shifted ten years. The shift of the stagflation index is used to show the decennial after-effects of stagflation. Hollywood does not immediately see rising differential profits from stagflation, but the plan yields results years later. (If the trend continues, the index of stagflation portends falling differential profits by the end of the present decade.)

As strikes tend to occur when Hollywood’s differential profits have fallen, the timing of management’s “”disappointment” is unlikely to be coincidental. Since 1960, Hollywood has only had one major period of employment growth — from 1990 to 2000. For the rest of Hollywood’s history from 1960, stagflation is the method to getting differential profits back on track.

When we think of a society experiencing a general period of stagflation, this economic phenomenon is so diffused that stagflation appears to have no clear author or source. But at the level of labour relations in a business sector, employees might notice how their companies drive and utilize periods of stagflation. Stagflation can also produce changes in the management-labour relationship of a business sector. To reduce the number of employees, management has to lay-off people. To freeze or slow growth, management might have additional layers of conservatism in business decisions or innovation. Price increases might not have direct impacts on day-to-day operations of workers, but the management-labour relationship can sour when employees sense that price increases do not or will not reflect positive improvements to products or services.

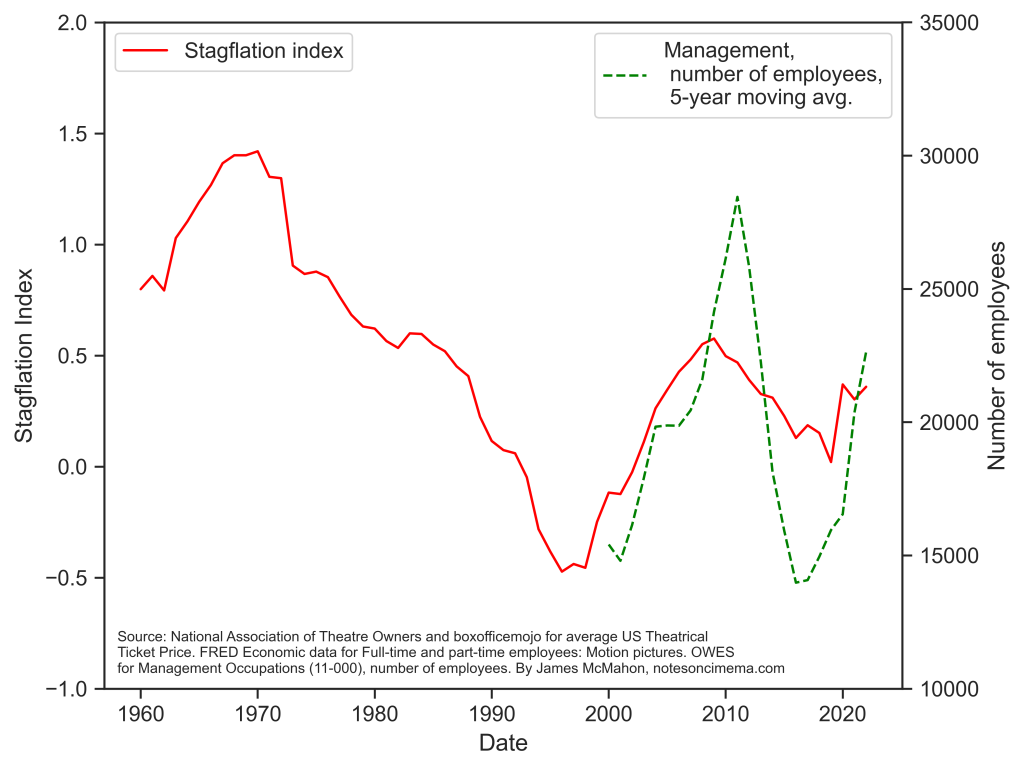

Figures 3 and 4 both indicate that the act of stagflation in Hollywood — which is the means for its dominant firms to differentially profit years later — has effects at the industrial level. Figure Z compares the stagflation index to the number of employees in management occupations in “Motion Picture and Video Industries”, as listed in the NAICS codes. It appears that a rise of stagflation creates demands for employment growth in management positions.

In periods of rising stagflation, Hollywood is likely to need a bigger army of managers to get rid of some employees and limit the aspirations of the rest. Moreover, job cuts and rising prices are likely to produce blowback when it effects the creativity of making films in Hollywood. How do these job cuts affect the creation of quality art? The playwright and film director David Mamet would likely surmise that creativity suffers when the ranks of Hollywood management grow:

The entry level position at motion picture studios is script reader. Young folks fresh from the rigours of the academy are permitted to beg for a job summarizing screenplays. These summaries will be employed by their betters in deliberations.

These higher-ups rarely (some, indeed, breathe the word “never”) read the actual screenplay; thus, the summaries, called “coverage”, become the coin of the realm.

Now, like anyone newly enrolled in a totalitarian regime, these neophytes get the two options pretty quickly–conform or die. Conformity, in this case, involves figuring out what the studios might like (money) and giving them the illusion that the dedicated employee, through strict adherence to the mechanical weeding process, can provide it. The script reader adopts the notion that inspiration, idiosyncrasy, and depth are all very well in their place but that their place has yet to be discovered and that he would rather die than deviate from received wisdom.

Mamet, D. (2007). Bambi vs. Godzilla: On the Nature, Purpose, and Practice of the Movie Business. New York: Pantheon Books

While it has fewer data than Figure 3, Figure 4 suggests that management also financially benefits during periods of rising stagflation. The dotted green line uses OEWS data and plots the ratio of the average hourly wage of management occupations to artistic occupations of actors, producers and directors, editors, writers and authors, and film and video editors.

Further Reading

Mamet, D. (2007). Bambi vs. Godzilla: On the Nature, Purpose, and Practice of the Movie Business. New York: Pantheon Books.

McMahon, James (2022). The Political Economy of Hollywood: Capitalist Power and Cultural Production. New York: Routledge.

Nitzan, J., & Bichler, S. (2009). Capital as Power: A Study of Order and Creorder. New York: Routledge.

One thought on “The political economic roots of Hollywood strikes, Part 3”