Missed Part 1? You should start here.

Around the time of this post, the WGA and the Alliance of Motion Picture and Television Producers (AMPTP) produced a tentative agreement in their 2023 negotiations. The WGA Negotiating Committee, the WGAW Board and WGAE Council all voted unanimously to recommend the agreement on September 26, 2023. As mentioned in Part 1, this series of posts looks at strikes in Hollywood over a period of 50 years. I am keen to analyze the 2023 Hollywood strikes in greater detail, but it will be at least a couple of months before published financial reports cover the period of the WGA and SAG-AFTRA strikes in 2023. For now, consider my political economic analysis of strikes in Hollywood to be something that might still apply to what we have witnessed in the last few months. – J

In the previous post, I borrowed a phrase from my colleagues to speak about a specific “danger zone” in Hollywood, which appears when the differential operating profits of the major Hollywood studios are falling. Like other measures of differential accumulation, differential operating profits fall when a change in the operating profits of a firm or set of firms is smaller than a change in the operating profits of a benchmark, such the biggest firms on the S&P 500. For example, a ten percent increase in a firm’s operating profits can look good on paper, but not if other firms are increasing their operating profits by more than ten percent. Conversely, loses of operating profit can look even worse if, despite other firms having a bad year as well, the loses are big, relative to a benchmark.

This post will try to explain why major Hollywood firms cannot easily get out of a danger zone when it appears, especially in the current era of conglomerate Hollywood. Increasing operating profits might be an obvious goal of businesses in Hollywood, but many growth-based solutions to increasing its profits are non-starters to executives and management of major studios. The differential power of the largest Hollywood studios are built on a system of risk reduction, which is rooted in the control of the creativity that goes into making films. Ceding this control in labour negotiations with actors, writers, directors and other creative jobs in Hollywood, even just a little bit, could create a breakdown in successful risk reduction; and Hollywood is not in a position to be indifferent about this type of breakdown. If risk reduction remains the primary strategy for Hollywood to differentially accumulate, future increases in profits from imagined waves of creative growth are unlikely to be big enough to compensate for increases in risk.

To demonstrate Hollywood’s predicament with empirical evidence, let us use a simple hypothetical to paint a picture of how expected earnings in Hollywood would be affected by an estimate of risk. A studio executive has decided to listen to the separate pitches of two producers in the same meeting. Producer A goes all in on Hollywood’s obsession with franchise cinema; the next film will be a clear derivative of everything that blockbuster Hollywood has been doing for the last ten years. Hell, the script will have so few original ideas that it could be written by cheap AI. Producer A estimates total profits of this film to be $100 million. Producer B is nauseated by Producer A’s pitch. Producer B looks to the studio executive and says that now is the time for Hollywood to revitalize the heart and soul of American cinema and embrace originality. If the studio green-lights Producer B’s idea to let talented people resurrect good storytelling, they can get $150 million in total profits!

Assuming that these levels of profits are reasonable, the studio executive should certainly prefer Producer B’s pitch to Producer A’s. Yet this studio executive is anxious and decides that Producer B failed to properly account for risk. Relative to Producer A’s project, the studio executive thinks the expected profits of Producer B’s pitch are twice as risky. Thus, $150 million in total profits becomes $75 million, which is $25 million less than Producer A’s estimate. Risk might not be the only variable in the capitalization of Hollywood cinema, but risk perceptions can temper the excitement of future profit.

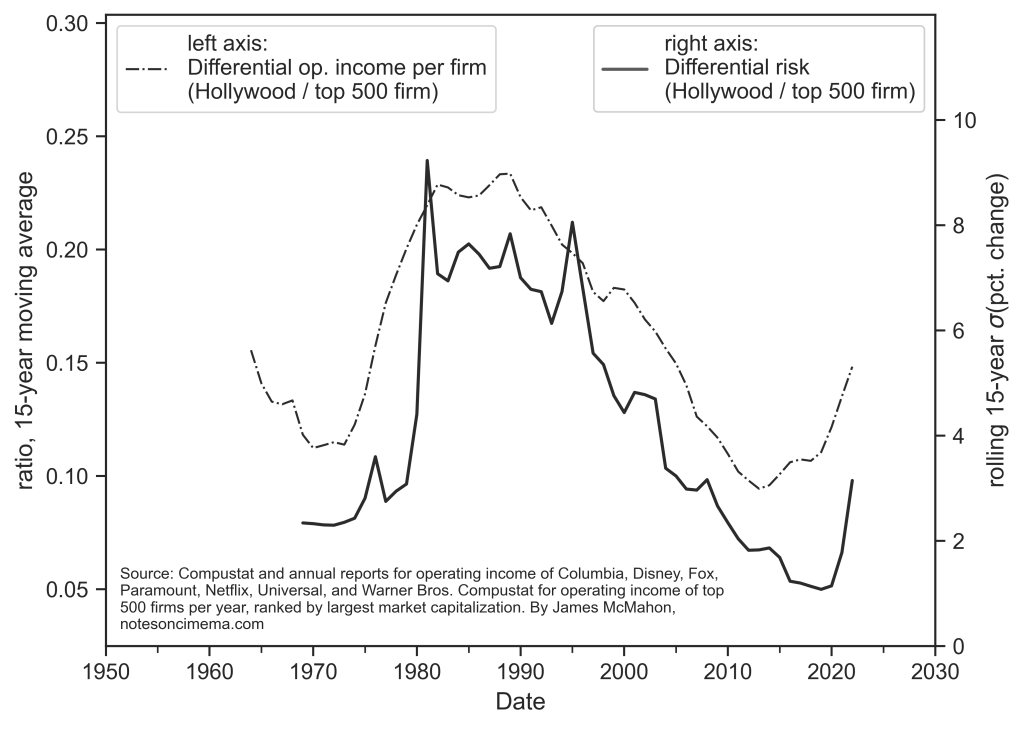

At a much larger scale than two producers trying to pitch a movie idea, Figure 1 visualizes the tricky relationship between profit and risk in the Hollywood film business. The left axis plots the per-firm differential operating profits of the major Hollywood studios (Columbia, Disney, Fox, Paramount, Netflix, Universal, and Warner Bros.). The series is smoothed as a 15-year moving average. The right axis plots my approach to measuring differential risk. A measure of differential risk is produced in three steps. First I calculate the annual percent changes of a 5-year smoothed series of operating profits per firm — for both the major Hollywood studios and the top 500 firms in Compustat, which is the database that was used to construct our benchmark that proxies the S&P 500. In the second step we apply a 15-year rolling standard deviation to both series of percent changes. For example, a measure in 1990 would be the standard deviation of the percent changes of operating profits from 1975 to 1990. Third, we divide Hollywood’s measure of risk by the benchmark, the measure of risk for the top 500 firms.

Figure 1 demonstrates how, over the long run, differential profits in Hollywood are not independent from differential risk. The two series in Figure 1 are technically “backward-looking”, as they measure published earnings, instead of expected profits, and volatility, instead of “forward-looking” confidence in future expectations. Nevertheless, it is the strength of the relationship that can help explain the tendency for labour strife to occur when Hollywood is in a danger zone. To just keep pace with other dominant capitalist firms, Hollywood’s earnings need to increase when the earnings of other firms are increasing. When the profits of the major Hollywood studios stagnate, there are infinite possibilities in the imagination of how Hollywood can increase profits from new or better creative strategies — e.g., green-light projects from new talent, search for alternative or marginalized stories, break from industry norms of pacing, play with visual styles. But strategies of more or better creative growth are foreclosed by any expected rise of differential risk, as a rise of risk deflates the level of expected profits (just like in the example of Producer B’s pitch).

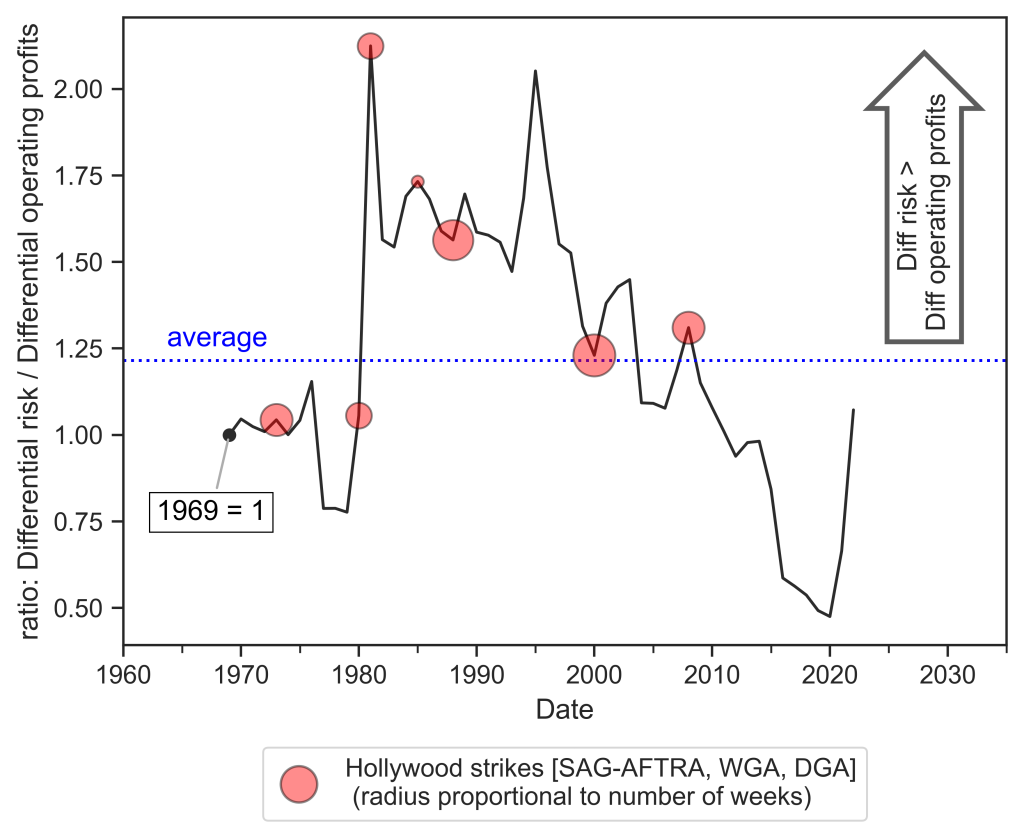

What remains when Hollywood is uninterested in getting out of danger zones with new growths in artistic creativity? Worsening labour conditions for the forms of creativity that the major studios will sanction, in both number of employed and the terms of employment. Figure 2 places the history of Hollywood strikes on a time series that measures the movements of profit and risk. In Figure 2 the series plots the ratio of differential risk to differential profits. With differential risk in the numerator, rises in the series occur when differential risk is rising faster than differential profit. Most of the strikes in Hollywood since 1970 occurred when differential risk increased more than differential profit. We also know from Part 1 that Hollywood strikes tend to occur when differential profits are falling. Figure 2 is touching on the same point, but in a way that helps show why the danger zone is tricky place for the major Hollywood studios.

TO BE CONTINUED …

Stay tuned for Part 3, where I will try to show what happens when major Hollywood firms are resistant to growth: we see long periods of stagflation. Unfortunately for the WGA, other Hollywood unions, and the public that appreciates good art, periods of stagflation hurt workers with unemployment and consumers with inflation.

Further Reading

McMahon, James (2022). The Political Economy of Hollywood: Capitalist Power and Cultural Production. New York:Routledge.

Mouré, Christopher. (2023). “Technological Change and Strategic Sabotage: A Capital as Power Analysis of the US Semiconductor Business.” Real-World Economics Review. No. 103. March. pp. 26-55.

Nitzan, J., & Bichler, S. (2009). Capital as Power: A Study of Order and Creorder. New York: Routledge

One thought on “The political economic roots of Hollywood strikes, Part 2”