Over the past century, Marxism has been radically transformed

in line with circumstances and fashion. Theses that once looked solid have

depreciated and fallen by the sideline; concepts that once were deemed

crucial have been abandoned; slogans that once sounded clear and

meaningful have become fuzzy and ineffectual.

But two key words seem to have survived the attrition and

withstood the test of time: imperialism and

financialism.[1]

Talk of imperialism and financialism – and particularly of the

nexus between them – remains as catchy as ever. Marxists of different

colours – from classical, to neo to post – find the two terms expedient,

if not indispensable. Radical anarchists, conservative Stalinists and

distinguished academics of various denominations all continue to use and

debate them.

The views of course differ greatly, but there is a common

thread: for most Marxists, imperialism and financialism are prime causes

of our worldly ills. Their nexus is said to explain capitalist development

and underdevelopment; it underlies capitalist power and contradictions;

and it drives capitalist globalization, its regional realignment and local

dynamics. It is a fit-all logo for street demonstrators and a generic

battle cry for armchair analysts.

The secret behind this staying power is flexibility. Over the

years, the concepts of imperialism and financialism have changed more or

less beyond recognition, as a result of which the link between them

nowadays connotes something totally different from what it meant a century

ago.

The purpose of this article is to outline this chameleon-like

transformation, to assess what is left of the nexus and to ask whether

this nexus is still worth keeping.

Empire and Finance

The twin notions of imperialism and financialism emerged at the

turn of the twentieth century. The backdrop is familiar enough. During the

latter part of the nineteenth century, the leading European powers were

busy taking over large tracts of non-capitalist territory around the

world. At the same time, their own political economies were being

fundamentally transformed. Since the two developments unfolded hand in

hand, it was only natural for theorists to ask whether they were related –

and if so, how and why.

The most influential explanation came from a British left

liberal, John Hobson, whose work on the subject was later extended and

modified by Marxists such as Rosa Luxemburg, Rudolf Hilferding, Vladimir

Lenin and Karl Kautsky, among others.[2]

Framed in a nutshell, the basic argument rested on the belief

that capitalism had changed: originally ‘industrial’ and ‘competitive’,

the system had become ‘financial’ and

‘monopolistic’.

This transformation, said the theorists, had two crucial

effects. First, the process of monopolization and the centralization of

capital in the hands of the large financiers made the distribution of

income far more unequal, and that greater inequality restricted the

purchasing power of workers relative to the productive potential of the

system. As a result of this imbalance, there emerged the spectre of

‘surplus capital’, excess funds that could not be invested profitably in

the home market. And since this ‘surplus capital’ could not be disposed of

domestically, it forced capitalists to look for foreign outlets,

particularly in pristine, pre-capitalist regions.

Second, the centralization of capital altered the political

landscape. Instead of the night-watchman government of the laissez-faire

epoch, there emerged a strong, active state. The laissez-faire capitalists

of the earlier era saw little reason to share their profits with the state

and therefore glorified the frugality of a small central administration

and minimal taxation. But the new state was no longer run by hands-off

liberals. Instead, it was dominated and manipulated by an aggressive

oligarchy of ‘finance capital’ – a coalition of large bankers, leading

industrialists, war mongers and speculators who needed a strong state that

would crack down on domestic opposition and embark on foreign military

adventures.

And so emerged the nexus between imperialism and financialism.

The concentrated financialized economy, went the argument, requires

pre-capitalist colonies where surplus capital can be invested profitably;

and the cabal of finance capital, now in the political driver’s seat, is

able to push the state into an international imperialist struggle to

obtain those colonies.

At the time, this thesis was not only totally new and highly

sophisticated; it also fit closely with the unfolding of events. It gave

an elegant explanation for the imperial bellicosity of the late nineteenth

century, and it neatly accounted for the circumstances leading to the

great imperial conflict of the first ‘World War’. There were of course

other explanations for that war – from realist/statist, to liberal, to

geopolitical, to psychological.[3] But for most intellectuals, these

alternative explications seemed too partial or instrumental compared to

the sweeping inevitability offered by the nexus of empire and

finance.

History, though, kept changing, and soon enough both the theory

and its basic concepts had to be altered.

Monopoly Capital

The end of the Second World War brought three major

transformations. First, the nature of international conflict changed

completely. Instead of a violent inter-capitalist struggle, there emerged

a Cold War between the former imperial powers on the one hand and the

(very imperial) Soviet bloc on the other (with plenty of hot proxy

conflicts flaring up in the outlying areas). Second, the relationship

between core and periphery was radically altered. Outright conquest and

territorial imperialism gave way to decolonization, while tax-collecting

navies were replaced by the more sophisticated tools of foreign aid and

foreign direct investment (FDI). Third and finally, the political

economies of the core countries themselves were reorganized. Instead of

the volatile laissez-faire regime, there arose a large welfare-warfare

state whose ‘interventionist’ ideologies and counter-cyclical policies

managed to reduce instability and boost domestic

growth.

On the face of it, this new constellation made talk of

finance-driven imperialism seem outdated if not totally irrelevant. But

the theorists didn’t give up the nexus. Instead, they gave it a new

meaning.

The revised link was articulated most fully by the Monopoly

Capital School associated with the New York journal Monthly Review.[4]

Capitalism, argued the writers of this school, remains haunted by a lack

of profitable investment outlets. And that problem, along with its

solution, can no longer be explained in classical Marxist

terms.

The shift from competition to oligopoly that began in the late

nineteenth century, these writers claimed, was now complete. And that

shift meant that Marx’s ‘labour theory of value’ and his notion of

‘surplus value’ had become more or less irrelevant to capitalist

pricing.

In the brave new world of oligopolies, the emphasis on

non-price competition speeds up the pace of technical change and

efficiency gains, making commodities cheaper and cheaper to produce. But

unlike in a competitive system, these rapid cost reductions do not

translate into falling prices. The prevalence of oligopolies creates a

built-in inflationary bias which, despite falling costs, makes prices move

up and sometimes sideways, but rarely if ever down.

This growing divergence between falling costs and rising prices

increases the income share of capitalists, and that increase reverses the

underlying course of capitalism. Marx believed that the combination of

ever-growing mechanization and ruthless competition creates a ‘tendency of

the rate of profit to fall’. But the substitution of monopoly capitalism

for free competition inverts the trajectory. The new system is ruled by an

opposite ‘tendency of the surplus to rise’.

The early theorists of imperialism, although using a different

vocabulary, understood the gist of this transformation. And even though

they did not provide a full theory to explain it, they realized that the

consequence of that transformation was to shift the problem of capitalism

from production to circulation (or in later Keynesian parlance, from

‘aggregate supply’ to ‘aggregate demand’). The new capitalism, they

pointed out, suffered not from insufficient surplus, but from too much

surplus, and its key challenge now was how to ‘offset’ and ‘absorb’ this

ever-growing excess so that accumulation could keep going instead of

coming to a halt.

That much was already understood at the turn of the twentieth

century. But this is where the similarity between the early theorists of

imperialism and the new analysts of Monopoly Capital

ends.

Black Hole: The Role of Institutionalized

Waste

Until the early twentieth century, it seemed that the only way

to offset the growing excess was productive and external: the surplus of

goods and capital had to be exported to and invested in pre-capitalist

colonies. But as it turned out, there was another solution, one that the

early theorists hadn’t foreseen and that the analysts of Monopoly Capital

now emphasized. The surplus could also be disposed off unproductively and

internally: it could be wasted at home.

For the theorists of Monopoly Capital, ‘waste’ denoted

expenditures that are necessary neither for producing the surplus nor for

reproducing the population, and that are, in that sense, totally

unproductive and therefore wasteful. These expenditures absorb existing

surplus without ever creating any new surplus, and this double feature

enables them to mitigate without ever aggravating the ‘tendency of the

surplus to rise’.

The absorptive role of wasteful spending wasn’t entirely new,

having already been identified at the turn of the twentieth century by

Thorstein Veblen.[5] But it was only after the Second Word War, with the

entrenchment of the Fordist model of mass production and consumption and

the parallel rise of the welfare-warfare state, that the process was fully

and conscientiously institutionalized as a salient feature of monopoly

capitalism.

By the end of the war, the U.S. ruling class grew fearful that

demobilization would trigger another severe depression; and having

accepted and internalized the stimulating role of large-scale government

spending, it supported the creation of a new ‘Keynesian Coalition’ that

brought together the interests of big business, the large labour unions

and various state agencies. The hallmark of this coalition was

immortalized in a secret U.S. National Security Council document (NSC-62),

whose writers explicitly called on the government to use high military

spending as a way of securing the internal stability U.S.

capitalism.[6]

According to its theorists, monopoly capitalism gave rise to

many forms of institutionalized waste – including a bloated sales effort,

the creation of new ‘desires’ for useless goods and services and the

acceleration of product obsolescence, among other strategies. But the two

most significant types of waste were spending on the military and on the

financial sector.

The importance of these latter expenditures, went the argument,

lies in their seemingly limitless size. The magnitude of military

expenditures has no obvious ceiling: it depends solely on the ability of

the ruling class to justify the expenditures on grounds of national

security. Similarly with the size of the financial sector: its magnitude

expands with the potentially limitless inflation of credit. This

convenient expandability turns military spending and financial

intermediation into a giant ‘black hole’ (our term): they suck in large

chunks of the excess surplus without ever generating any excess surplus of

their own.[7]

Now, on the face of it, the efficacy of this domestic black

hole should have made imperialism less necessary if not wholly redundant.

According to the theorists of Monopoly Capital, though, this would be the

wrong conclusion to draw. It is certainly true that, unlike the old

imperial system, monopoly capitalism no longer needs colonies. But the

absence of formal colonies is largely a matter of appearance. Remove this

appearance and you’ll see the imperial impulse pretty much intact: the

core continues to exploit, dominate and violate the periphery for its own

capitalist ends.[8]

Spearheaded by U.S.-based multinationals and no longer hindered

by inter-capitalist wars, argued the theorists, the new order of monopoly

capitalism has become increasingly global and ever more integrated. And

this global integration, they continued, has come to depend on an

international division of labour, free access to strategic raw materials

and political regimes that are ideologically open for business. However,

these conditions do not develop automatically and peacefully. They have to

be actively promoted and enforced – often against stiff domestic

opposition – and they have to be safeguarded against external threats (the

Soviet bloc before its collapse, Islamic fundamentalism and rogue states

since then, etc.). And because such promotion and enforcement hinge on the

threat and frequent use of violence, there is an obvious justification if

not outright need for a large, well-equipped army sustained by large

military budgets.

In this context, military spending comes to serve a dual role:

together with the financial sector and other forms of waste, it propels

the accumulation of capital by black-holing a large chunk of the economic

surplus; and it helps secure a more sophisticated and effective

neo-imperial order that no longer needs colonial territories but is every

bit as expansionary, exploitative and violent as its crude imperial

predecessor.

Dependency

This dependency, went the argument, is the outcome of five

hundred years of colonial destruction. During that period, the imperial

powers systematically undermined the socio-economic fabric of the

periphery, making it totally dependent on the core. In this way, when

decolonization finally started, the periphery found itself unable to take

off while the capitalist core prospered. There was no longer any need for

core states to openly colonize and export capital to the periphery. Using

their disproportionate economic and state power, the former imperialist

countries were now able to hold the postcolonial periphery in a state of

debilitating economic monoculture, political submissiveness and cultural

backwardness – and, wherever they could, to impose on it a system of

unequal exchange.

Unequal exchange can take different forms. It may involve a

wage gap between the ‘less exploited’ labour aristocracy of the core and

the ‘more exploited’ simple labour of the periphery. Or the core can

compel the periphery to buy its exports at ‘high’ prices (relative to

their ‘true’ value), while importing the periphery’s products at ‘low’

prices (relative to their ‘true’ value). As a result of this latter

difference, the terms of trade get ‘distorted’, surplus is constantly

siphoned into the core (rather than exported from or domestically absorbed

by the core), and the eviscerated periphery remains chronically

underdeveloped.[10]

This logic of dependent underdevelopment was first articulated

during the 1950s and 1960s as an antidote to the liberal modernization

thesis and its Rostowian promise of an imminent takeoff.[11] And at the

time, that antidote certainly seemed to be in line with the chronic

stagnation of peripheral countries.

But what started as a partial theory soon expanded into a

sweeping history of world capitalism. According to this broader narrative,

capitalism was and remained imperial from the word go: it didn’t simply

start with conquest; it started because of conquest. Its very inception

was predicated on geographical exploitation and domination – a process in

which the financial-commercial metropolis (say England) used the surplus

extracted from a productive periphery (say India) to kick-start its own

economic growth. And once started, the only way for this growth to be

sustained is for the metropolis to continue to eviscerate the periphery

around it. The development of the emperor depends on and necessitates the

underdevelopment of its subjects.

The next theoretical step was to fit this template into an even

broader concept of a World System – an all-encompassing global approach

that seeks to map the hierarchical political relationships, division of

labour and flow of commodities and surplus between the peripheral

countries at the bottom, the semi-peripheral satellites in the middle and

the financial core at the apex. From the viewpoint of this larger

retrofit, capitalism is no longer the outcome of a specific class

struggle, a conflict that developed in Western Europe during the twilight

of feudalism and later spread to and reproduced itself in the rest of the

world. Instead, capitalism – to the extent that this term can still be

meaningfully used – is merely the outer appearance of Europe’s imperial

expedition to rob and loot the rest of the world.

This view reflected a fundamental change in emphasis. Whereas

earlier Marxist theorists of imperialism accentuated the centrality of

exploitation in production, dependency and World System analysts shifted

the focus to trade and unequal exchange. And while previous theories

concentrated on the global class struggle, dependency and World System

analyses spoke of a conflict between states and geographical regions. The

new framework, although nominally ‘Marxist’ on the outside, has little

Marxism left on the inside.[12]

And if we are to believe the postists who quickly jumped on the

dependency bandwagon, there is nothing particularly surprising about this

particular theoretical bent. After all, ‘history’ is no more than an

ethno-cultural clash of civilizations, a never-ending cycle of imperial

‘hegemonies’ in which the winners (ego) impose their ‘culture’ on the

losers (alter).[13] To the naked eye, the totalizing capitalization of our

contemporary world may seem like a unique historical process. But don’t be

deceived. This apparent uniqueness is a flash in the pan. Deconstruct it

and what you are left with is yet another imperial imposition – in this

case, the imposition of a Euro-American ‘financialized discourse’ on the

rest of the world.

Red Giant: An Empire

Imploded

The dependency version of the nexus, though, didn’t hold for

long, and in the 1970s the cards again got shuffled. The core stumbled

into a multifaceted crisis: the United States suffered a humiliating

defeat in Vietnam, stagflation decelerated and destabilized the major

capitalist countries and political unrest seemed to undermine the

legitimacy of the capitalist regime itself. In the meantime, the periphery

confounded the theorists: on the one hand, import substitution, the

prescribed antidote to dependency, pushed developing countries, primarily

in Latin America, into a debt trap; on the other hand, the inverse policy

of privatization and export promotion, implemented mostly in East Asia,

triggered an apparent ‘economic miracle’. Taken together, these

developments didn’t seem to sit well with the notion of Western financial

imperialism. And so, once more the nexus had to be

revised.

According to the new script, ‘financialization’ is no longer a

panacea for the imperial power. In fact, it is prime evidence of imperial

decline.

The reasoning here goes back to the basic Marxist distinction

between ‘industrial’ activity on the one hand and ‘commercial’ and

‘financial’ activities on the other. The former activity is considered

‘productive’ in that it generates surplus value and leads to the

accumulation of ‘actual’ capital. The latter activities, by contrast, are

deemed ‘unproductive’; they don’t generate any new surplus value and

therefore, in and of themselves, do not create any ‘actual’

capital.

This distinction – which most Marxists accept as sacrosanct –

has important implications for the nexus of imperialism and financialism.

It is true, say the advocates of the new script, that finance (along with

other forms of waste) helps the imperial core absorb its rising surplus –

and in so doing prevents stagnation and keeps accumulation going. But

there is a price to pay. The addiction to financial waste ends up

consuming the very fuel that sustains the core’s imperial position: it

hollows out the core’s industrial sector, it undermines its productive

vitality, and, eventually, it limits its military capabilities. The

financial sector itself continues to expand absolutely and relatively, but

this is the expansion of a ‘red giant’ (our term) – the final inflation of

a star ready to implode.

The process leading to this implosion is emphasized by theories

of hegemonic transition.[14] The analyses here come in different versions,

but they all seem to agree on the same basic template. According to this

template, the maturation of a hegemonic power – be it Holland in the

seventeenth century, Britain in the nineteenth century or the United

States presently – coincides with the ‘over-accumulation’ of capital (i.e.

the absence of sufficiently profitable investment outlets). This

over-accumulation – along with growing international rivalries, challenges

and conflicts – triggers a system-wide financial expansion, marked by

soaring capital flows, a rise in market speculation and a general

inflation of debt and equity values. The financial expansion itself is led

by the hegemonic state in an attempt to arrest its own decline, but the

reprieve it offers can only be temporary. Relying on finance drains the

core of its energy, causes productive investment to flow elsewhere and

eventually sets in motion the imminent process of hegemonic transition.

Although the narrative here is universal, its inspiration is

clearly drawn from the apparent ‘financialized decline’ of U.S. hegemony.

Since the 1970s, many argue, the country has been ‘depleted’: it has grown

overburdened by military spending; it has gotten itself entangled in

unwinnable armed conflicts, and it has witnessed its industrial-productive

base sucked dry by a Wall Street-Washington Complex that prospers on the

back of rising debt and bloated financial

intermediation.[15]

In order to compensate for its growing weakness, these

observers continue, the United States has imposed its own model of

‘financialization’ on the rest of the world, hoping to scoop the resulting

expansion of liquidity. Some states have been compelled to replicate the

model in their own countries, others states have been tempted to finance

it by buying U.S. assets, and pretty much all states have been pulled into

an unprecedented global whirlpool of capital flow.

The spread of ‘financialization’, though, has only been party

successful. For a while, the United States benefited from being able to

control, manipulate and leverage this expansion for its own ends. But in

the opinion of many, the growing severity of recent financial, economic

and military crises suggests that this ability has been greatly reduced

and that U.S. hegemony is now coming to an end.

The highly publicized nature of these imperial misgivings makes

this latest version of the nexus seems persuasive. But when we look more

closely at the facts, the theoretical surface no longer seems smooth; and

as we get even closer to the evidence, cracks begin to

appear.

Start with the cross-border flow of capital, the international

manifestation of ‘financialization’. This process is often misunderstood,

even by high theorists, so a brief clarification is in order. Contrary to

popular belief, the flow of capital is financial, and only financial. It

consists of legal transactions, whereby investors in one country buy or

sell assets in another – and that is it. There is no flow of material or

immaterial resources, productive or otherwise. The only things that move

are ownership titles.[16]

These changes in ownership, of course, are of great importance.

If the flow of capital is large enough, the stock of foreign owned assets

will grow relative to domestically owned assets. And as the ratio rises,

the ownership of capital becomes increasingly

transnational.

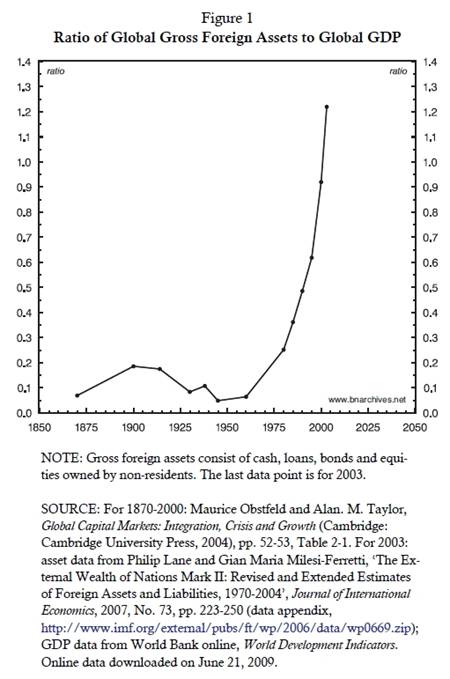

The history of this process, from 1870 to the present, is

sketched in Figure 1, where we plot the total value of all foreign assets

as a percent of global GDP (both denominated in dollars). The underling

numbers, admittedly, are not very accurate. The raw data on foreign

ownership are scarce; often they are of questionable quality; rarely if

ever are they available on a consistent basis; and almost always they

require painstaking research to collate and heroic assumptions to

calibrate. There are also huge problems in estimating global GDP,

particularly for earlier periods. But even if we take these severe

limitations into consideration, the overall picture seems fairly

unambiguous.[17]

The figure shows three clear periods: 1870-1900, 1900-1960 and

1960-2003. The late nineteenth century, marked by the imperial expansion

of ‘finance capital’, saw the ratio of global foreign assets to global GDP

more than double – from 7% in 1870 to 19% in 1900. This upswing was

reversed during the first half of the twentieth century. The mayhem

created by two world wars and the Great Depression on the one hand and the

emergence of domestic ‘institutionalized waste’ on the other undermined

the flow of capital and caused the share of foreign ownership to recede.

By 1945, with the onset of decolonization under U.S. ‘hegemony’ and the

beginning of the Cold War, the ratio of foreign assets to global GDP hit a

record low of 5%. This was the nadir. The next half century brought a

massive reversal. In the early 1980s, when Ronald Reagan and Margaret

Thatcher announced the beginning of neoliberalism, the ratio of foreign

assets to GDP was already higher than in 1900; and, by 2003, after a

quarter century of exponential growth, it reached an all time high of

122%.

This final number represents a significant level of

transnational ownership. According to recent research by the McKinsey

Global Institute, between 1990 and 2006 the global proportion of

foreign-owned assets has nearly tripled, from 9% to 26% of all world

assets (both foreign and domestically-owned). The increase was broadly

based: foreign ownership of corporate bonds rose from 7% to 21% of the

world total, foreign ownership of government bonds rose from 11% to 31%

and foreign ownership of corporate stocks rose from 9% to

27%.[18]

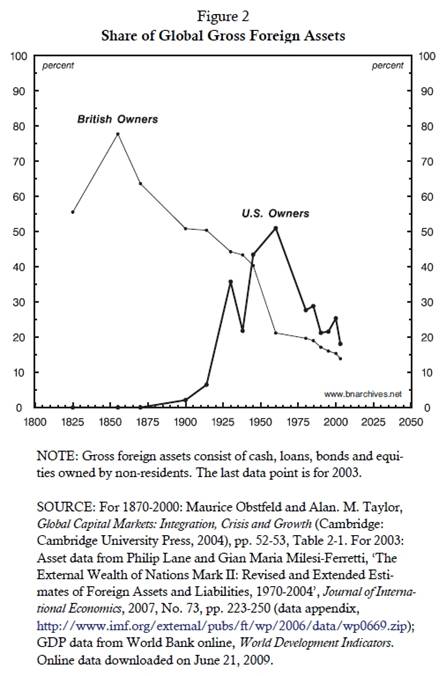

The next step is to break the aggregate front and examine the

distribution of ownership. This is what we do in Figure 2, which compares

the foreign asset shares of British and U.S. owners from 1825 to the

present. The chart shows two important differences between the earlier era

of ‘classical imperialism’ dominated by Britain and the more recent

‘neo-imperial’ period led by the United States.

First, there is the pattern of decline. British owners saw

their share of global assets fall from the mid-nineteenth century onward,

but until the end of the century their primacy remained intact. The real

challenge came only in the twentieth century, when capital flow

decelerated sharply and foreign asset positions were unwound; and it was

only in the interwar period, when foreign investment gave way to capital

flight, that the share of British owners fell below

50%.

The U.S. experience was very different. U.S. owners achieved

their primacy right after the Second World War, when capital flow had

already been reduced to a trickle – and that position was undermined the

moment capital flow started to pick up. In 1980, when U.S.

‘financialization’ started in earnest, U.S. owners accounted for only 28%

of global foreign assets. And by 2003, when record capital flow and the

U.S. invasion of Afghanistan and Iraq prompted many Marxists to pronounce

the dawn of an ‘American Empire’, the asset share of U.S. owners was

reduced to a mere 18%.

Second, there is the identity of the leading owners. In the

previous transition, power shifted from owners in one core country

(Britain) to those in another (the United States). By contrast, in the

current transition (assuming one indeed is underway) the contenders are

often from the periphery. In recent years, owners from China, OPEC,

Russia, Brazil, Korea and India, among others, have become major foreign

investors with significant international positions – including large

stakes in America’s ‘imperial’ debt.

Does this shift of foreign ownership represent the rising

hegemony of countries such as China – or is what we are witnessing here

yet another mutation of imperialism? Perhaps, as some observers seem to

imply, we’ve entered a (neo) neo-imperial order in which the ‘Empire’

actually boosts its power by selling off its assets to the

periphery?

The Global Distribution of

Profit

Surprising as it may sound, such a selloff is not inconsistent

with the basic theory of hegemonic transition. To reiterate, according to

this theory, hegemonic transitions are always marked by a financial

explosion which is triggered, led and leveraged by the core in a vain

attempt to arrest its imminent decline. Supposedly, this explosion enables

the hegemonic power to amplify its financial supremacy in order to

(temporarily) retain its core status and power. And if retaining that

power requires the devolution of foreign assets and the selloff of

domestic ones, so be it.

The question is how to assess this power. How do we know

whether the core’s attempt to leverage global ‘financialization’ is

actually working? Is there a meaningful benchmark for power, and how

should this benchmark be used and understood?

Unfortunately, most theorists of hegemonic transitions tend to

avoid the nitty gritty data, so it’s often unclear how they themselves

gauge the shifting trajectories of global power. But given the

hyper-capitalist nature of our epoch, it seems pretty safe to begin with

the bottom line: net profit.

Net profit is the pivotal magnitude in capitalism. It

determines the health of corporations, it tells investors how to

capitalize assets, it sets limits on what government officials feel they

can and cannot do. It is the ultimate yardstick of capitalist power, the

category that subjugates the social individual and makes the whole system

tick. It is the one magnitude than no researcher of capitalism can afford

to ignore.

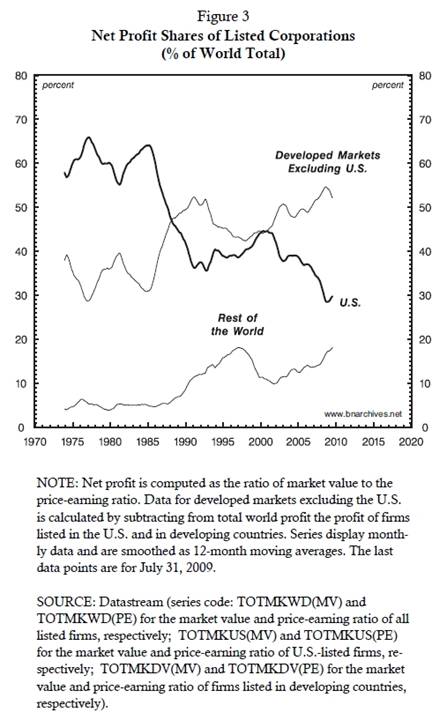

With this obvious rationale in mind, consider Figure 3, which

traces the distribution of global net profit earned by publicly-traded

corporations. The chart, covering the period from 1974 to the present,

shows three profit series, each denoting the profit share of a distinct

corporate aggregate: (1) firms listed in the United States; (2) firms

listed in developed markets excluding the United States; and (3) firms

listed in the rest of the world – i.e. in ‘emerging

markets’.

The data demonstrate a sharp reversal of fortune. Until the

mid-1980s, U.S.-listed firms dominated: they scooped roughly 60% of all

net profits, leaving firms listed in other developed markets 35% of the

total and those listed in ‘emerging market’ less than

5%.

But then the tables turned. During the second half of the

1980s, the net profit share of U.S.-listed firms plummeted, falling to 36%

in less than a decade. The 1990s seemed to have stabilized the decline,

but in the early 2000s the downward drift resumed. By the end of the

decade, U.S. firms saw their net profit fall to 29% of the world

total.

The other two aggregates moved in the opposite direction. By

2009, the profits of firms listed in developed countries other than the

U.S. reached 53% of the total, while the share of ‘emerging market’ firms

quadrupled to 18%.

These numbers, of course, should be interpreted with care.

First, note that our profit data here cover only publicly traded firms;

they don’t include unlisted, private firms. This fact means that

variations in profit shares reflect two very different processes: (1)

changes in the amount of profit earned by listed firms, and (2) the pace

of listing and delisting of firms. The latter factor became important

during the late 1980s and 1990s, when Europe and the ‘emerging markets’

saw their stock market listings swell with many private corporations going

public – this at a time when the number of listed firms in the United

States remained flat.

Second, the location of a firm’s listing says nothing about its

operations and owners. Many firms whose shares are traded in the financial

centres of the United States and Europe in fact operate elsewhere. And

then there is the issue of ultimate ownership. Recall that currently one

third of all global assets are owned by foreigners. This proportion is

already large enough to make it difficult to determine the ‘nationality of

capital’, and if it were to rise further the whole endeavour would become

an exercise in futility.

The theoretical implications of these caveats have received

little or no attention from students of hegemonic transitions, and their

quantitative implications remain unclear. But even if we take the

‘nationality of capital’ at face value and consider the numbers in Figure

3 as accurate, it remains obvious that ‘financialization’ has not worked

for the hegemonic power: despite the alleged omnipotence of its Wall

Street-Washington Complex, despite its control over key international

organizations, despite having imposed neoliberalism on the rest of the

world, and despite its seemingly limitless ability to borrow funds and

suck in global liquidity – the bottom line is that the net profit share of

U.S. listed corporations has kept falling and

falling.

The Engine of

‘Financialization’

Now, in and of itself, the collapse of the U.S. profit share –

much like the selloff of U.S. assets – isn’t at odds with the theory of

hegemonic transition. To repeat, this theory suggests that the

hegemonic/imperial power, having been weakened by its prior financial

excesses (among other ills), will kick-start, promote and sustain a

system-wide process of ‘financialization’. According to the theory, the

latent purpose is to leverage this process in order to slow down the

hegemon’s own decline – but nowhere does the theory say that this

‘strategy’, whether conscious or not, has to

succeed.

Presented in this way, the story sounds historically

compelling, logically consistent and empirically convincing – but only if

we can first establish one basic fact. We need to show that the global

process of ‘financialization’ indeed has been led by the United States.

This is the starting point. Only if U.S. ‘financialization’ preceded, was

bigger than and propelled ‘financialization’ in the rest of the world can

we speak of the U.S. leveraging this process for its own ends. And only

then can we assess whether that leveraging succeeded or

failed.

So let’s look at the evidence.

Concepts and Methods

The initial step in this sequence is to measure

‘financialization’. Conceptually, the task may seem simple. All we need to

do is calculate the share of financial activity in overall economic

activity and then trace the trajectory of the resulting ratio. When this

ratio goes up, we can say that the economy is being ‘financialized’; when

it comes down we would conclude that it is being

‘de-financialized’.

But that’s easier said than done.[19]

The basic difficulty is that capitalism is mediated through

money, and that fact makes every mediated activity both ‘economic’ and

‘financial’ at the same time. As we have already seen, heterodox

economists bypass the problem by defining ‘finance’ more narrowly to

denote activities that merely shuffle money and credit without producing

‘real’ goods and services (and obviously without generating any surplus

value and ‘actual capital’). Unfortunately, though, this yardstick isn’t

very practical. In order to use it, the economist needs to know which

activity is ‘productive’ and which is not; and yet, strange as it may

sound, this is something that economists do not – and indeed cannot –

know. Despite hundreds of years of theorizing and endless claims to the

contrary, they remain unable to actually measure ‘productivity’. They

cannot quantify the productivity of the CEO of a large bank – or of an

auto mechanic for that matter. In fact, they don’t even have the units

with which to measure such productivity.

The only thing they can do is to assume. Mainstream economists

assume that productivity is ‘revealed’ by income, so if the CEO earns

1,000 times more than the mechanic, he must be 1,000 more productive.

Marxists reject this arbitrary assumption; instead, they stipulate, also

arbitrarily, that financiers are unproductive while mechanics are

productive – although this claim still leaves them unsure of how to treat

actual corporations, where ‘unproductive’ and ‘productive’ activities are

always inextricably intertwined.

The net result is that we don’t have a clear theoretical

definition for ‘finance’ and therefore no objective way to assess the

extent of ‘financialization’.

But not all is lost.

We certainly can stick with conventions – and the convention,

at least among capitalists and investors, is to treat ‘finance’ as

synonymous with the FIRE sector; i.e. with firms whose primary activities

involve financial intermediation (banking, trust funds, brokerages, etc.),

insurance or real estate.

Based on this conventional (albeit theoretically loose)

definition of finance, and given our specific concern here with capitalist

power, it seems appropriate to proxy the extent and trajectory of

‘financialization’ by looking at the share of total net profit accounted

for by FIRE corporations. The magnitude of this share would indicate the

extent to which FIRE firms have been able to leverage ‘financialization’

for their own end, and the way this share changes over time would tell us

whether their leverage has increased or decreased.

The Inconvenient Facts

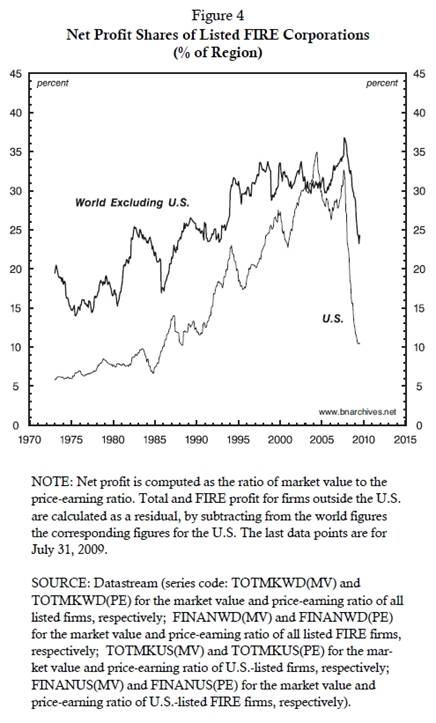

This distributional measure of ‘financialization’ is depicted

by the two series in Figure 4. The first series shows the net profit of

FIRE corporations as a percent of the net profit of all U.S.-listed firms.

The second series computes the same ratio for firms listed outside the

United States.

And here we run into a little

surprise.

According to the theory of hegemonic transition, the engine of

‘financialization’ is the United States. This is the black hole of the

World System. It is the site where finance has been used most extensively

to absorb the system’s surplus. It is the seat of the all-powerful Wall

Street-Washington Complex. It is where neoliberal ideology first took

command and from where it was later imposed with force and temptation on

the rest of the world. It is the engine that led, pulled and pushed the

entire process.

But the facts in Figure 4 seem to tell a different story.

According to the chart, the United Sates has not been leading the process.

If anything, it seems to have been ‘dragged’ into the process by the rest

of the world. . . .

During the early 1970s, before the onset of systemic

‘financialization’, the U.S. FIRE sector accounted for 6% of the total net

profit of U.S.-listed firms. At the time, the comparable figure for the

rest of the world was 18% – three times as high! From then on, the United

States was merely playing catch-up. Its pace of ‘financialization’ was

faster than in the rest of the world; but with the sole exception of a

brief period in the late 1990s, its level of ‘financialization’ was always

lower. In other words, if wish to stick with the theory of a

finance-fuelled red giant that is slowly imploding as its peripheral

liquidly runs out, we should apply that theory not to the United States,

but to the rest of the world!

Indeed, even the most recent period of crisis seems at odds

with the theory. According to the conventional creed, both left and right,

the current crisis is payback for the sins of excessive ‘financialization’

and improper bubble blowing.[20] In this Galtonean theory, deviations and

distortions always revert to mean, ensuring that the biggest sinners end

up suffering the most. And since the U.S. FIRE sector was supposedly the

main culprit, it was also the hardest hit.

The only problem is that, according to Figure 4, the U.S.

wasn’t the main culprit. On the eve of the crisis, the extent of

‘financialization’ was greater in the rest of the world than in the U.S.

And yet, although the world’s financiers committed the greater sin, it was

their U.S. counterparts who paid the heftier price. The former saw their

profit share decline mildly from 37% to 25% of the total, while the latter

watched their own share crash from 32% to 10%.

The gods of finance must have their own sense of

justice.

The End of a Nexus?

Of course, this isn’t the first time that a monkey wrench has

been thrown into the wheels of the ever-changing nexus of imperialism and

financialism. As we have seen, over the past century the nexus had to be

repeatedly altered and transformed to match the changing reality. Its

first incarnation explained the imperialist scramble for colonies to which

finance capital could export its ‘excessive’ surplus. The next version

talked of a neo-imperial world of monopoly capitalism where the core’s

surplus is absorbed domestically, sucked into a ‘black hole’ of military

spending and financial intermediation. The third script postulated a World

System where surplus is imported from the dependent periphery into the

financial core. And the most recent edition explains the hollowing out of

the U.S. core, a ‘red giant’ that had already burned much of its own

productive fuel and is now trying to ‘financialize’ the rest of the world

in order to use the system’s external liquidity.

Yet, here, too, the facts refuse to cooperate: contrary to the

theory, they suggest that U.S. ‘Empire’ has followed rather than led the

global process of ‘financialization’ and that U.S. capitalists have been

less dependent on finance than their peers

elsewhere.

Of course, this inconvenient evidence could be dismissed as

cursory – or, better still, neutralized by again adjusting the meaning of

imperialism and financialism to fit the new reality. But maybe it’s time

to stop the carousel and cease the repeated retrofits. Perhaps we need to

admit that, after a century of transmutations, the nexus of imperialism

and financialism has run its course, and that we need a new framework

altogether.

Jonathan Nitzan and Shimshon

Bichler are co-authors of Capital as Power: A Study of Order and

Creorder, RIPE series in Global Political Economy (London and New York:

Routledge, 2009). All their publications are freely available from The

Bichler & Nitzan Archives

(http://bnarchives.net)

Endnotes

[1] The precise terms are rather loose and their use varies

across theorists and over time. Imperialism, empire and colonialism are

used interchangeably, as are finance, fictitious capital finance capital,

financialization and financialism. Here we use imperialism and

financialism simply because they rhyme.

[2] John. A. Hobson, Imperialism: A Study (Ann Arbor:

University of Michigan Press, 1902 [1965]); Rosa Luxemburg, The

Accumulation of Capital, with an introduction by Joan Robinson, translated

by A. Schwarzschild (New Haven: Yale University Press, 1913 [1951]);

Rudolf Hilferding, Finance Capital: A Study of the Latest Phase of

Capitalist Development, edited with an introduction by Tom Bottomore, from

a translation by Morris Watnick and Sam Gordon (London: Routledge &

Kegan Paul, 1910 [1981]); Vladimir I. Lenin, ‘Imperialism, The Highest

State of Capitalism’, in Essential Works of Lenin. ‘What Is to Be Done?’

and Other Writings (New York: Dover Publications, Inc., 1917 [1987]), pp.

177-270; Karl Kautsky, ‘Ultra-Imperialism’, New Left Review, 1970, No. 59

(Jan/Feb), pp. 41-46 (original German version published in

1914).

[3] See, for example, Joseph A. Schumpeter, Imperialism and

Social Classes, with an introduction by Bert Hoselitz, translated by Heinz

Norden (New York: Meridian Books, 1919; 1927 [1955]); Barbara Wertheim

Tuchman, The Guns of August (New York: Macmillan, 1962) and The Proud

Tower: A Portrait of the World Before the War, 1890-1914 (New York:

Macmillan, 1966); and Paul M. Kennedy, The Rise and Fall of the Great

Powers (New York: Random House, 1987), Ch. 5.

[4] Some of the important contributions to this literature

include Josef Steindl, Maturity and Stagnation in American Capitalism (New

York: Monthly Review Press, 1952 [1976]); Shigeto Tsuru, ‘Has Capitalism

Changed?’ in Has Capitalism Changed? An International Symposium on the

Nature of Contemporary Capitalism, edited by S. Tsuru (Tokyo: Iwanami

Shoten, 1956), pp. 1-66. Paul A. Baran and Paul M. Sweezy, Monopoly

Capital: An Essay on the American Economic and Social Order (New York:

Modern Reader Paperbacks, 1966); and Harry Magdoff, The Age of

Imperialism: The Economics of U.S. Foreign Policy, 1st Modern Reader ed.

(New York: Monthly Review Press, 1969).

[5] Veblen’s early analysis is articulated in The Theory of

Business Enterprise (Clifton, New Jersey: Augustus M. Kelley, Reprints of

Economics Classics, 1904 [1975]).

[6] See U.S. National Security Council, NSC 68: United States

Objectives and Programs for National Security. A Report to the President

Pursuant to the President's Directive of January 31, 1950. Top Secret

(Washington DC, 1950); David A. Gold, ‘The Rise and Fall of the Keynesian

Coalition’, Kapitalistate, 1977, Vol. 6, No. 1, pp. 129-161; and Jonathan

Nitzan and Shimshon Bichler, ‘Cheap Wars’, Tikkun, August 9,

2006.

[7] Classical Marxists interpret the role of waste rather

differently. In their account, wasteful spending withdraws surplus from

the accumulation process; this withdrawal reduces the pace at which

constant capital accumulates; and that reduction lessens the tendency of

the rate of profit to fall. See for example Michael Kidron, Capitalism and

Theory (London: Pluto Press, 1974).

[8] Perhaps the clearest advocate of this argument was the late

Harry Magdoff, a writer whose empirical and theoretical studies stand as a

beacon of scientific research; for a summary, see his Imperialism Without

Colonies (New York: Monthly Review Press, 2003). Similar claims (minus the

research) are offered by Ellen Meiksins Wood, Empire of Capital (London

and New York: Verso, 2003).

[9] Some of the important texts here include Raúl Prebisch, The

Economic Development of Latin America and its Principal Problems (New

York: United Nations, 1950); Paul A. Baran, The Political Economy of

Growth (New York and London: Modern Reader Paperbacks, 1957); Andre Gunder

Frank, Capitalism and Underdevelopment in Latin America: Historical

studies of Chile and Brazil (New York: Monthly Review Press, 1967);

Arghiri Emmanuel, Unequal Exchange. A Study of the Imperialism of Trade

(New York: Monthly Review Press, 1972); Eduardo H. Galeano, Open Veins of

Latin America: Five Centuries of the Pillage of a Continent (New York:

Monthly Review Press, 1973). Samir Amin, Accumulation on a World Scale: A

Critique of the Theory of Underdevelopment. 2 vols. (New York: Monthly

Review Press. 1974); Immanuel Maurice Wallerstein, The Modern

World-System. Capitalist Agriculture and the Origins of the European

World-Economy in the Sixteenth Century (New York: Academic Press, 1974)

and The Modern World-System II: Mercantilism and the Consolidation of the

European World-Economy, 1600-1750 (New York: Academic Press, 1980); and

Fernando Henrique Cardoso and Enzo Faletto, Dependency and Development in

Latin America (Berkeley: University of California Press,

1979).

[10] The inverted commas in this paragraph highlight concepts

that the theory of unequal exchange can neither define nor measure. Since

nobody knows the correct value of labour power, it is impossible to

determine the extent of ‘exploitation’ in the two regions. Similarly,

since no one knows the ‘true’ value of commodities, there is no way to

assess the extent to which export and import prices are ‘high’ or ‘low’.

This latter ignorance makes it impossible to gauge the degree to which the

terms of trade are ‘distorted’ and, indeed, in whose favour; and given

that we don’t know the magnitude or even the direction of the

‘distortion’, it is impossible to tell whether surplus flows from the

periphery to the core or vice versa, and how large the flow might

be.

[11] W.W. Rostow, The Stages of Economic Growth: A

Non-Communist Manifesto (Cambridge, England: Cambridge University Press,

1960).

[12] The question of what constitutes a ‘proper’ Marxist

framework is highlighted in the debates over the transition from feudalism

to capitalism. Important contributions to these debates are Maurice Dobb,

Studies in the Development of Capitalism. London: Routledge & Kegan

Paul Ltd., 1946. [1963]); Paul M. Sweezy ‘A Critique’, in The Transition

from Feudalism to Capitalism, Introduction by Rodney Hilton, edited by R.

Hilton (London: Verso, 1950 [1978]); Robert Brenner, ‘The Origins of

Capitalist Development: A Critique of Neo-Smithian Marxism’, New Left

Review, 1977, No. 104 (July-August), pp. 25-92; and Robert Brenner, ‘Dobb

on the Transition from Feudalism to Capitalism’, Cambridge Journal of

Economics, 1978, Vol. 2, No. 2 (June), pp. 121-140. For edited volumes on

this issue, see Rodney Hilton, ed., The Transition from Feudalism to

Capitalism, Introduction by Rodney Hilton (London: Verso, 1978); and T. H.

Aston and C. H. E. Philpin, eds., The Brenner Debate: Agrarian Class

Structure and Economic Development in Pre-Industrial Europe (Cambridge and

New York: Cambridge University Press, 1985).

[13] For a typical narrative, see John M. Hobson, The Eastern

Origins of Western Civilisation. (Cambridge, UK and New York: Cambridge

University Press. 2004).

[14] See for example, Fernand Braudel, Civilization &

Capitalism, 15th-18th Century, translated from the French and revised by

Sian Reynolds, 3 vols. (New York: Harper & Row, Publishers, 1985);

Immanuel Maurice Wallerstein, The Politics of the World-Economy: The

States, the Movements, and the Civilizations (Cambridge, New York and

Paris: Cambridge University Press and Editions de la Maison des sciences

de l'homme, 1984); and Giovanni Arrighi, The Long Twentieth Century:

Money, Power, and the Origins of Our Times. London: Verso,

1994.

[15] For the ‘depletion thesis’, see for example Seymour

Melman, Pentagon Capitalism: The Political Economy of War, 1st ed. (New

York: McGraw-Hill, 1970) and The Permanent War Economy: American

Capitalism in Decline (New York: Simon and Schuster, 1974). A broader

historical application is given in Paul M. Kennedy, The Rise and Fall of

the Great Powers (New York, NY: Random House: 1987).

[16] The generalization here applies to portfolio as well as

direct foreign investment. Both are financial transactions, pure and

simple. The only difference between them is their relative size:

typically, investments that account for less than 10% of the acquired

property are considered portfolio, whereas larger investments are

classified as direct. The flow of capital, whether portfolio or direct,

may or may not be followed by the creation of new productive capacity. But

the creation of such capacity, if and when it happens, is conceptually

distinct, temporally separate and causally independent from the mere act

of foreign investment.

[17] The early data on foreign assets are incomplete in that

they do not cover all countries (especially smaller ones). As a result,

the measured ratio of foreign assets to global GDP in the earlier years of

the chart may be somewhat understated (see Maurice Obstfeld and Alan. M.

Taylor, Global Capital Markets: Integration, Crisis and Growth [Cambridge:

Cambridge University Press, 2004], pp. 51-57).

[18] See Diana Farrell, Susan Lund, Christian Fölster, Raphael

Bick, Moira Pierce, and Charles Atkins, Mapping Global Capital Markets.

Fourth Annual Report (San Francisco: McKinsey Global Institute, January

2008), p. 73, Exhibit 3.10.

[19] For a detailed analysis of the associated difficulties and

impossibilities that we discuss here only in passing, see Jonathan Nitzan

and Shimshon Bichler, Capital as Power: A Study of Order and Creorder (New

York and London: Routledge, 2009), Chs. 6-8 and 10; and Shimshon Bichler

and Jonathan Nitzan, ‘Contours of Crisis II: Fiction and Reality’, Dollars

& Sense, April 28, 2009.

[20] See Shimshon Bichler and Jonathan Nitzan, ‘Contours of Crisis: Plus ça change, plus c'est pareil?’ Dollars & Sense, December 29, 2008; and ‘Contours of Crisis II: Fiction and Reality’, Dollars & Sense, April 28, 2009.