Testing the Labour Theory of Value: An Exchange

Paul Cockshott, Shimshon Bichler and Jonathan Nitzan

Glasgow, Jerusalem and Toronto

December, 2010

Table of Contents

Introduction by Shimshon Bichler and Jonathan Nitzan

Open Letter from Paul Cockshott

Interpolation by Nitzan and Bichler

Pages 92-97 from Nitzan and Bichler’s Capital as Power (2009)

A Final Note by Bichler and Nitzan

Link to an external Excel File: The Effect of Spurious Correlation

Introduction by Shimshon Bichler and Jonathan Nitzan

December 1, 2010

On October 29-31, the Forum on Capital as Power held a three-day conference at York University, dedicated to the subject of Crisis of Capital, Crisis of Theory. A day before the conference, Stefanos Kourkoulakos sent an Open Letter to Professors George Comninel, David McNally, Leo Pantich and Jonathan Nitzan, who were to participate as Faculty Guest Speakers at the event. He enumerated some of Nitzan and Bichler’s critiques of Marx’s labour theory of value. These critiques – presented a year earlier in a departmental seminar – remained unanswered, and Kourkoulakos asked the Guest Speakers to respond to them in their conference presentations.

Following the conference, we received an Open Letter from Paul Cockshott of the University of Glasgow in Scotland (below). His letter commented on one of the questions posed by Kourkoulakos, and Cockshott asked us to post it on our website. We decided not to do so, and for a simple reason: Cockshott was replying to our critique without having read it. So we wrote back:

November 13, 2010

Dear Paul Cockshott:

Thank you for your Open Letter. Unfortunately, your intervention doesn’t address the problem; it merely reproduces it.

Shimshon Bichler and I wrote a book in 2009 titled Capital as Power. The book articulates a broad critique of conventional and Marxist political economy. It contains three chapters that deal directly with Marx’s labour theory of value, including, among other things, 20th-century attempts to empirically test that theory (such as your own research and the research of others you mention). The book also lays out the beginning of an alternative approach to political economy.

This is the background for Stefanos’ Open Letter. As I read it, the letter is a general call to Marxists: engage with new critical theories and evidence, or be left with a dogma.

It seems to me that your reply does exactly what Stefanos warns against. Judging by your text, I assume you haven’t read our book. But this doesn’t prevent you from reiterating your position, regardless of the argument we level against it.

If and when you do read our book, we will gladly consider your critique.

With best wishes,

Jonathan

Cockshott promptly replied:

November 13, 2010

Ok, your book is among the many I have not read, but now that you tell me that you address the issue of the empirical tests of the labour theory of value, I will examine the arguments in it and perhaps get back to you.

We thought that the matter was closed, at least for the time being. But it wasn’t. After his email to us, Cockshott wrote to Kourkoulakos. He said that Nitzan ‘rejected’ his Open Letter (without indicating the reason) and asked Kourkoulakos to have the letter circulated by other means. Kourkoulakos posted it on GRAPSCI (the listserv for York University’s political science graduate students).

We are not entirely sure why Cockshott is so eager to debate something he hasn’t read. But since he insists, a reply seems in order. The text below reproduces Cockshott’s letter, followed by a relevant section from Capital as Power (2009) and a brief comment on Cockshott’s own work. The interested reader can also consult the linked Excel file, where we illustrate the consequence of spurious correlation for testing.

Open Letter from Paul Cockshott

November 10, 2010

Dear Jonathan Nitzan and BNArchives readers

I have read with interest the Open Letter from Stefanos Kourkoulakos and the reply by Leo Panitch. I would like, if you allow, to add some comments on the following part of the exchange.

• Do Marx’s value categories and the theory built upon, and by means of, them hold water?

Not without a lot of leaks, and yet there is much that is valuable in Marx’s theory that is not built on them, or by means of them alone.

The principal thrust of criticism of the labour theory of value within orthodox economics has been from the dominant subjectivist theory of value, which locates the origin of prices in the relative subjective utility of commodities to the consumer. This is what is taught in all elementary economics textbooks, and the rise of this school of value theory can be seen as a late 19th- or early 20th-century response to the political influence of Marxian socialism [3].

A subsequent round of criticisms [11, 7, 6] claimed that the labour theory was not so much wrong as redundant, since the work of Sraffa [10] apparently showed that a non-subjectivist theory of price could be formulated without recourse to labour value.

If a theory purports to be scientific rather than a dogma, it must produce testable predictions. It must be possible to make observations or carry out procedures that would either confirm or undermine it. In this sense the labour theory of value starts out from a much stronger position than the subjectivist theory. Whilst there may be some questions of how one measures labour input, these pale to insignificance compared to the problem of providing an objective measure of subjective utility. One can propose mechanisms for the labour theory to be confronted with evidence which might refute it. It is much harder to see how the same might be done with the utility theory of value, whose scientific status is thus questionable. The alleged discrediting of the labour theory of value in orthodox economics has entirely been based on a-priori theoretical arguments. It has not been discredited by the discovery of empirical evidence that was inconsistent with the theory. In science competing theories are supposed to be evaluated on the basis of their ability to explain observed data. Economics does not proceed in this way. The practical political implications of different economic theories are so great that it is very difficult for scientific objectivity to take hold. Whilst people build political parties on the basis of different economic theories, they don’t fight in the same way over alternative theories of galactic evolution.

It was not until the 1980s that a serious scientific effort was made to test whether or not the labour theory of value actually held in practice. The pioneering work was done by Anwar Shaikh [8, 9] and his collaborators [5, 4] at the New School in New York. Following this, there is now a considerable body of econometric evidence in favour of the proposition that relative prices and relative labour values are highly correlated, or in other words, in favour of the law of value.

Even prior to this empirical work, the ground-breaking theoretical investigations of Farjoun and Machover [2, 1] had undermined the assumptions which underlay deterministic approaches to value theory. Their work, employing the formalisms of statistical mechanics, was a response to the impasse reached by the input-output method of representing an economy, in particular when applied to the theory of economic value. Farjoun and Machover’s innovations include the systematic introduction of probabilistic modelling, statistical mechanics, and probabilistic laws to the field of political economy. They rejected the adequacy of deterministic models to capture essential features of a dynamic and distributed market economy, which they viewed as a complex system characterised by a huge number of degrees of freedom. Employing probabilistic arguments, Farjoun and Machover developed a broad model of the capitalist economy that, in contrast to deterministic approaches, had a more immediate connection to empirical reality and yielded important and theoretically distinct macroeconomic conclusions, including probabilistic laws governing the relationship between price and labour-content and the distribution of the profit rate. The conclusions in their book have, by subsequent econometric work, been found to be broadly correct.

The key to testing the labour theory of value, and in particular to testing the predictions of Farjoun and Machover, has been the use of input-output tables.

It is possible to use input-output tables to work out how many hours of labour went into producing the total output of each industry.

If the labour theory of value is empirically correct, then if you spend a dollar on any product you get back roughly the same quantity of labour. What happens when you look at a real economy?

The work of calculating labour contents would have been daunting prior to the ready availability of computers for economic research. This may be why nobody seriously investigated the matter until the 1980s. But when Shaikh and others tried, they obtained promising results.

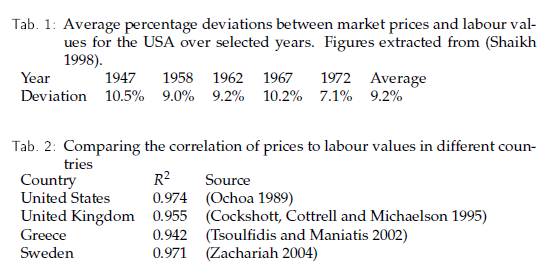

The general procedure in these studies has been to use data from national input-output tables to calculate the total labour content of the output of each industrial sector, and then to see how closely the aggregate money value of sales from each industry matches its total labour content. Various different ways have been devised to measure the correspondence between the prices and the values. Shaikh (1984) explains the details of the process, and also offers a theoretical argument in favour of a logarithmic specification of the price-value regressions. Table 1 shows some results from Shaikh and his collaborators.

As you can see, the average error you get when predicting United States prices using the labour theory of value is only about 9%. This has proven to be the case across many industries and several decades.

An alternative way of measuring the similarity of prices to labour values is to draw a scatter plot relating the two and then try to fit a straight line to the data. If the labour theory of value is true, then the observations will tend to fall close to this line, and the line will pass through the origin. How close the observations are to the line is measured by what is termed the R2 value of the data. If the R2 = 1 then all points fall on the line and the line perfectly predicts the results. If the R2 = 0 then the line is of no use at all in predicting the observations.

Studies utilizing data from the United States, Sweden, Greece, Italy, Yugoslavia, Mexico and the UK have produced remarkably consistent results, with strong correlations observed: R2 s of well over .90. It also seems to be the case from the literature that the larger the population of the country, the closer is the fit between observed prices and labour values (Table 2). This may be an example of the way that statistical regularities become more apparent the larger the population on which the observations are performed.

I would say that correlations in prediction of the order of 95% are pretty good for an economic theory. The only scientifically convincing criticism of a theory is the presentation of a better theory – one that is more elegant in the sense of not having ‘epicycles’ and is also able to make more accurate predictions. The critics of the labour theory of value have yet to present such a theory. In fact they have neglected the most basic scientific procedure: the need to make empirical tests of any theory advanced.

Yours sincerely,

Paul Cockshott

Notes

[1] E Farjoun, "Production of commodities by means of what?", 1984.

[2] Emmanuel Farjoun and Moshe Machover, Laws of chaos, a probabilistic approach to political economy, Verso, London, 1983.

[3] J.P. Henderson, The Retarded Acceptance of the Marginal Utility Theory: Comment, The Quarterly Journal of Economics (1955), 465–473.

[4] E. M. Ochoa, Values, prices, and wage–profit curves in the us economy, Cambridge Journal of Economics 13 (1989), 413–29.

[5] P. Petrovic, The deviation of production prices from labour values: some methodology and empirical evidence, Cambridge Journal of Economics 11 (1987), 197– 210.

[6] J. Roemer, Should Marxists be interested in exploitation?, Cambridge University Press, Cambridge, 1986.

[7] P. A. Samuelson, Reply on Marxian matters, Journal of Economic Literature 11 (1973), 64–68.

[8] A. M. Shaikh, The transformation from Marx to Sraffa, Ricardo, Marx, Sraffa – the Langston Memorial Volume (Ernest Mandel and Alan Freeman, eds.), Verso, London, 1984, pp. 43–84.

[9] ---, The empirical strength of the labour theory of value, Marxian Economics: A Reappraisal (R. Bellofiore, ed.), vol. 2, Macmillan, 1998, pp. 225–251.

[10] Piero Sraffa, Production of commodities by means of commodities, Cambridge University Press, Cambridge, 1960.

[11] Ian Steedman, Marx after Sraffa, Verso, London, 1981.

Interpolation by Nitzan and Bichler

December 1, 2010

Our book Capital as Power (2009) offers a radical alternative to the neoclassical and Marxist cosmologies of capitalism. Laying the ground for this alternative, the second part of the book, titled ‘The Enigma of Capital’, examines the foundations of the neoclassical utility theory of value and the Marxist labour theory of value. The general conclusion of this section is that consumption and production in general and utility and labour time in particular cannot offer a basis for a theory of capitalism.

Capitalism is a social system denominated in prices. This fact explains why each of the two general cosmologies of capitalism rests on its own theory of valuation: liberalism on a utility theory of value and Marxism on a labour theory of value. However, contrary to the claims of their advocates, in practice these theories cannot tell us anything about prices in general and capital accumulation in particular. There are numerous reasons for this inability, the most important of which is that the elementary particles of these theories – the neoclassical util and the Marxist socially necessary abstract labour time – cannot be shown to exist in the first place (for more on the subject, see our 2009 paper, ‘Capital as Power: Toward a New Cosmology of Capitalism’).

The text below, excerpted from our book, focuses on the narrow subject of empirical tests of Marx’s labour theory of value. It explains what testers such as Cockshott have tried to achieve; it shows why so far all of them have failed; and it suggests that, as long as they remain bound to their dogma, they are unlikely to give up.

‘. . .

What does the labour theory of value theorize?

The ambivalence of Marxists toward subjective considerations, power and ‘fictitious’ capital has had an important consequence: by excluding the role of these factors in principle while recognizing it in practice, they have made their labour theory of value logically ‘weightless’. As it stands, there is nothing in the theory itself to tell us whether labour values explain 1 per cent of prices, 99 per cent, or anything in between, and whether this explanatory power remains stable or changes over time.

This predicament hasn’t been lost on Marxists, and rather than fight a losing battle most have opted out. Marx’s labour theory of value, many now argue, is not a ‘price theory’ – at least not in the conventional liberal sense. Marx was primarily a critic of classical political economy, they say, and as such, he wasn’t concerned with the precise determination of price levels:

Whatever may be the way in which the prices of various commodities are first fixed or mutually regulated, the law of value always dominates their movement. If the labor time required for the production of these commodities is reduced, prices fall; if it is increased, prices rise, other circumstances remaining the same.

(Marx 1909, Vol. 3: 208, emphases added)

Note the emphases: value does not determine but merely dominates market prices, and it affects not their level but their movement. More broadly, according to this view Marx was not really interested in the price of chewing gum or the day-to-day fluctuations of a particular sector. These were epiphenomenal:

Magnitude of value expresses a relation of social production, it expresses the connection that necessarily exists between a certain article and the portion of the total labour-time of society required to produce it. As soon as the magnitude of value is converted into price, the above necessary relation takes the shape of a more or less accidental exchange-ratio between a single commodity and another, the money-commodity.

(Marx 1909, Vol. 1: 114)

For Marx, then, the issue was not individual prices but the general tendencies of capitalism. And this broad emphasis shouldn’t be surprising. The period he was writing in had witnessed great strides in probability and statistics. The concept of least-squares deviations from mean, developed by both Gauss and Legendre in the late eighteenth century, was already widely used, while Galton’s reversion to mean was just around the corner. The notion of approximating the underlying truth from multiple imprecise measurements, first applied in the geodesic derivation of the standard metre, was gaining adherents in every science.[1]

In line with these developments, Marx, too, was searching for the long-term ‘fundamentals’, the mean equilibrium values around which prices oscillate and to which they ultimately revert:

The assumption that the commodities of the various spheres of production are sold at their value implies, of course, only that their value is the center of gravity around which prices fluctuate, and around which their rise and fall tends to an equilibrium.

(Marx 1909, Vol. 3: 210)

Now, here we have a possible re-entry point. Marx’s pronouncement was difficult to corroborate in his own time, but nowadays, with abundant statistics and cheap computing power, it shouldn’t be too hard to assess. All it takes is a simple chart. You plot the historical trajectories of labour values and prices of production; on these you superimpose the historical movement of actual prices; and then you look and see. The resulting pattern, mediated if need be by statistical paraphernalia, should be able to tell you both the extent to which the law of value governs prices – with short-term precision, in the long run only, or not at all – and how this pattern may have changed over time.

And, indeed, as we shall see in the next section, Marxists have taken on this task. Since the late 1970s, they have subjected the labour theory of value to rigorous testing – with results that seem to prove more than Marx could ever have hoped for. In general, the studies show that values govern prices not only in the long run, but also in the fairly immediate term, and that they do so very tightly and consistently across space and over time.

And so, in the end, everything falls into place. Although we do not live in a perfectly competitive capitalism, and although prices are subject to the impact of numerous factors other than labour time, none of this matters a great deal. In the final empirical analysis, Marx was right. Capitalism does seem to obey his law of value.

Or does it?

Testing the labour theory of value

The problem is surprisingly simple. The purpose of testing the labour theory of value is to show that market prices are positively correlated with labour values (or with their corresponding prices of production). Now, irrespective of how one approaches this task, two things must be known beforehand: prices and values. And yet it turns out that these seemingly trivial magnitudes are not so easy to ‘know’ and that, contrary to their explicit proclamation, the empirical studies do not appear to even try to correlate prices and values.

The price of what?

Begin with prices. Most people think of these as attributes of individual commodities – the price of a Toyota Corolla, the price of a bushel of wheat, the price of a United Airlines flight from New York to Tokyo. Price could also be an attribute of a group of commodities. The GDP deflator of the beverage industry, for instance, denotes the weighted average price of all newly produced commodities in that industry, while similar deflators express the weighted average price for entire sectors such as consumer and investment goods, or even the economy as a whole.

Marxist studies of price–value correlations, however, deal with neither of these concepts. Instead of looking at the price of a single commodity or the average price of a group of commodities, they focus on the price of total output – that is, on the unit price of the commodity multiplied by its quantity. Typically, the researcher divides an economy into a few dozen sectors as delineated by the national statistical service, estimates the price and value of total output in each of these sectors, and then correlates these two magnitudes across sectors for one or more years.

This shift in focus has significant statistical implications. Correlations measured in this way reflect the co-variations not only of unit prices and values, but also of their associated quantities. Now, note that the unit value and unit price of each sector are multiplied by the same output. This fact means that, all other things being equal, the greater the size-variability of output across the different sectors, the tighter the correlation between their total price and total value.[2] And since different sectors do vary in their output size, the common result is to make the overall correlation bigger than the underlying correlation between unit prices and values. The extent of this impact is revealed when sectors are controlled for their size: the value–price correlations usually drop sharply, often to insignificant levels.[3]

Absence of value

The other problem with empirical studies has to do with values – or rather the lack thereof. To our knowledge, all Marxist models that purport to correlate prices with values do no such thing. Instead of correlating prices with values, they in fact correlate prices with . . . prices!

The reason is simple enough. Recall that, according to Marx, the value of a commodity denotes the abstract labour time socially necessary for its production. Yet, as we already mentioned and elaborate further here and in Chapter 8, this quantum is impossible to measure. And so the researcher makes assumptions.

The most important of these assumptions are that the value of labour power is proportionate to the actual wage rate, that the ratio of variable capital to surplus value is given by the price ratio of wages to profit, and occasionally also that the value of the depreciated constant capital is equal to a fraction of the capital’s money price. In other words, the researcher assumes precisely what the labour theory of value is supposed to demonstrate.[4]

Duncan Foley tries to put a brave face on this circularity by describing it as a matter of convenience:

. . . the choice of an embodied labor coefficients [sic] or a market price accounting system does not make much practical difference to estimates of Marxian categories like the rate of exploitation, or the ratio of unproductive to productive labor in real economies. Given the wide availability of market price accounting data in financial and government sources, and the expense, difficulty, and possible error involved in reconstructing embodied labor coefficients for many periods and economies from input/ output tables, most empirical work. . . will use market price data as a first approximation to an embodied labor coefficients system of accounts.

(Foley 2000: 35)

But this account is misleading. The issue isn’t convenience, it’s necessity. The imperative of this procedure was succinctly if opaquely stated in one of the first statistical studies:

In order to compute the rate of surplus value, input/output flows in market prices (hereafter prices) must be converted into input/output flows in labor time (hereafter values).

(Wolff 1975: 936, emphasis added)

In short, we have to pretend. Since values are forever unknown, we need to first convert prices into ‘values’ and then correlate the result with prices. It seems reasonable to expect the outcome to be positive and tight. After all, we are correlating prices with themselves. What remains unclear is why one would bother to show this correlation and, more puzzling still, how the whole excise relates to the labour theory of value.[5]

Notes

[1] On the intertwined evolution of probability and statistics, scientific measurements and liberal political economy, see Hacking (1975; 1990), Porter (1995), Alder (1995; 2002) and the collection of Klein and Morgan (2001).

[2] Denote, for the i-th sector, unit market price by mpi, unit labour value by lvi and the level of output by qi. The correlation across sectors between unit price and unit value associates mpi ↔ lvi, whereas the correlation across sectors between the total price of the output and the total value of the output associates qi × mpi ↔ qi × lvi. Note that in the latter correlation qi is common to both magnitudes.

[3] On the issue of spurious correlation, see Freeman (1998) and the debate between Kliman (2002; 2005; 2007: Ch. 11) and Cockshott and Cottrell (2005). The latter writers argue that, since commodities have no universal quantities (a box of breakfast cereal cannot be directly compared to a passenger aircraft), the correlation between their unit price and unit value is meaningless. This problem of incomparable units could easily be bypassed by correlating relative prices with relative values. In our example here, we would correlate the ratio between the price of cereal and the price of aircraft on the one hand with the ratio between the value of cereal and the value of aircraft on the other.

[4] To avoid undue attention, these assumptions are often tucked in endnotes and technical appendices. Commonly, the researcher will state them cryptically, with minimal discussion and seldom with an apology. See, for example, Wolff (1975: 936), Ochoa (1989: 427-29), Shaikh and Tonak (1994: 80-81), Alemi and Foley (1997: 2) and Cockshott and Cottrell (2005: 312).

[5] Some Marxists have questioned the wisdom of empirically testing the labour theory of value, lest the results prove inconclusive: ‘Suppose, for example, that the correlations between embodied labor coefficients and market prices had turned out to be much lower, or to fall over time, or to be low in certain capitalist economies. Are we to conclude that the labor theory of value does not hold, or is weakening over time, or holds only in some capitalist economies?’ (Foley 2000: 20). The writer leaves these questions unanswered.

References

Alder, Ken. 1995. A Revolution to Measure: The Political Economy of the Metric System in France. In The Values of Precision, edited by M. N. Wise. Princeton, N.J.: Princeton University Press, pp. 39-71.

Alder, Ken. 2002. The Measure of All Things. The Seven-Year Odyssey and Hidden Error that Transformed the World. New York: Free Press.

Alemi, Piruz, and Duncan K. Foley. 1997. The Circuit of Capital, U.S. Manufacturing and Non-Financial Corporate Business Sectors, 1947-1993. Monograph: 1-23.

Cockshott, Paul, and Allin Cottrell. 2005. Robust Correlations Between Prices and Labour Values: A Comment. Cambridge Journal of Economics 29 (2, March): 309-316.

Foley, Duncan K. 2000. Recent Developments in the Labor Theory of Value. Reivew of Radical Political Economics 32 (1): 1-39.

Freeman, Alan. 1998. The Transformation of Prices into Values: Comments on the Chapters by Simon Mohum and Anwar M. Shaikh. In Marxian Economics. A Reappraisal. Volume 2: Essays on Volume III of Capital: Profit, Prices and Dynamics, edited by R. Bellofiore. London: Mcmillan, pp. 270-275.

Hacking, Ian. 1975. The Emergence of Probability. A Philosophical Study of Early Ideas about Probability, Induction and Statistical Inference. London and New York: Cambridge University Press.

Hacking, Ian. 1990. The Taming of Chance. Cambridge and New York: Cambridge University Press.

Klein, Judy L., and Mary S. Morgan, eds. 2001. The Age of Economic Measurement. Annual Supplement to Volume 33 of History of Political Economy. Durham and London: Duke University Press.

Kliman, Andrew. 2002. The Law of Value and Laws of Statistics: Sectoral Values and Prices in the US Economy, 1977-97. Cambridge Journal of Economics 26 (3): 299-311.

Kliman, Andrew. 2005. Reply to Cockshott and Cottrell. Cambridge Journal of Economics 29 (2, March): 317-323.

Kliman, Andrew. 2007. Reclaiming Marx’s Capital. A Refutation of the Myth of Inconsistency. Lanham, MD: Lexington Books.

Marx, Karl. 1909. Capital. A Critique of Political Economy. 3 vols. Chicago: Charles H. Kerr & Company.

Ochoa, E. 1989. Values, Prices and Wage-Profit Curves in the U.S. Economy. Cambridge Journal of Economics 13 (3, September): 413-430.

Porter, Theodore M. 1995. Trust in Numbers. The Pursuit of Objectivity in Science and Public Life. Princeton, N.J.: Princeton University Press.

Shaikh, Anwar M., and E. Ahmet Tonak. 1994. Measuring the Wealth of Nations. The Political Economy of National Accounts. Cambridge and New York: Cambridge University Press.

Wolff, Edward N. 1975. The Rate of Surplus Value in Puerto Rico. Journal of Political Economy 83 (5, October): 935-950.

. . .’

In his Open Letter, Cockshott claims that ‘In science competing theories are supposed to be evaluated on the basis of their ability to explain observed data’ and that ‘One can propose mechanisms for the labour theory to be confronted with evidence which might refute it’. He further argues that ‘It is much harder to see how the same might be done with the utility theory of value, whose scientific status is thus questionable’.

The critique of the neoclassical utility theory of value is certainly correct. One key reason why this theory cannot be tested is that its elementary particle – the util – is unknowable. Neoclassicists bypass this problem – at least in their own minds – by going in reverse: they assume that dollar market prices ‘reveal’ utility and that dollar income flows reveal ‘factor productivity’. With this revelation, they can then go on to ‘measure’ (again, in their own minds) the util quantities of the so-called ‘real economy’ – from the ‘real’ flows of production and consumption to the ‘real’ stocks of assets and capital.

Cockshott claims that this isn’t the case with Marx’s labour theory of value. Unlike the neoclassical util, the elementary particle of Marxism – socially necessary abstract labour time – can be objectively observed and measured. ‘It is possible’, he says, ‘to use input-output tables to work out how many hours of labour went into producing the total output of each industry’.

But this claim is false.

In fact – and as Cockshott knows full well – the only way to ‘know’ labour values is the neoclassical way: by revelation. Whereas neoclassicists assume that prices reveal utils, Marxists assume that prices reveal socially necessary abstract labour time. And that is it.

As they stand, the quantities of utils and labour values exist not as empirical observations, but as religious-like visions. They emerge not from open-ended research and scientific exploration, but from circular rituals that make them true by definition.

This is how Cockshott himself describe the process in one of his recent works:

Unfortunately . . . we have no such independent data on values. This would require a fully disaggregated input-output table along with data on labour inputs in hours. When we compute industry values in practice, our primary data are nothing other than industry costs: we infer values from these costs, with unavoidable error. There are three sources of divergence between the underlying true values and the estimates of values derived using industry cost figures.

1. Values are defined in terms of hours of socially necessary labour time, but in most empirical work direct labour hours are proxied by the wage bill.

2. The assumption that the rate of surplus value is uniform across sectors: most if not all empirical work on value employs this assumption, yet it is not likely to be strictly true.

3. The aggregation issue: each of the sectors or industries used in an empirical study represents the aggregation of a wide range of production processes. The aggregation is, of course, done in terms of monetary values. Thus the weights carried by each sub-sector in the formation of any given sector’s figures depend on market prices, which by assumption exhibit some degree of divergence from values.

(Cockshott and Cottrell, Robust Correlations Between Prices and Labour Values: A Comment. Cambridge Journal of Economics, Vol. 29, No. 2, March, 2005, pp. 312-313, emphases added.)

The precise details of the procedure are often opaque, but the gist of it seems simple enough. First, being unable to know the quantity of socially necessary abstract labour hours embedded in commodities, Cockshott resorts to deducing this number from observable prices.[1] He does so by assuming that the direct number of hours (Marx’s v) is revealed by the dollar wage bill and that the indirect number of hours (Marx’s c) is revealed through iterative imputations of the dollar wage bill incurred in producing the non-labour inputs. And since, in and of themselves, labour values can never be known, this revelation, just like the neoclassical revelation of utility and ‘factor productivity’, can never be falsified.

Second, Cockshott doesn’t correlate average unit price with average unit labour time (as revealed by average unit dollar cost with some transformation). Instead, he correlates total sales with total labour values (as revealed by total dollar cost with some transformation). This move from individual commodities to sectoral aggregates introduces the further hazard of spurious correlation (see the linked Excel file).

Taken together, these assumptions enable Cockshott to show that there is a tight correlation between the aggregate dollar sales and the aggregate dollar costs of different sectors. What remains unclear is how these unsurprising price correlations relate to Marx’s labour theory of value – and, moreover, why Cockshott is convinced that they constitute a scientific proof of that theory.

Notes

[1] Cockshott and Cottrell write that in order to observe labour values directly, we would need ‘a fully disaggregated input-output table along with data on labour inputs in hours’. To the uninitiated reader, this statement may give the impression that the inconvenience is temporary, and that at some point in the future, when the fully disaggregated input-output table is finally made available, labour values could be observed directly. But this impression is misleading. The hour-denominated input-output table that Cockshott and Cottrell refer to – much like the util-denominated input-output table that the neoclassicists fancy – is a fiction. To know this table is to know labour values (or util ‘factor productivity’, in the case of the neoclassicists). But since labour values, just like utils, cannot be shown to exist, the table can be drawn only by those willing to assume the impossible.