The Nordhaus Racket: How to use capitalization to minimize the cost of climate change and win a ‘Nobel’ for ‘sustainable growth’

from Shimshon Bichler and Jonathan Nitzan

The LA Times called the bluff: William D. Nordhaus won the Nobel prize in economics for a climate model that minimized the cost of rising global temperatures and undermined the need for urgent action.

‘The economics Nobel went to a guy who enabled climate change denial and delay’:

It has been a scary month in climate science. Hurricane Michael and a frightening report from the U.N. Intergovernmental Panel on Climate Change underlined the potential costs of human-caused global warming. Then to add insult to injury, William Nordhaus won the economics Nobel Prize.

Nordhaus was recognized for his work developing a model to guide policymakers on how best to address the costs and benefits of limiting greenhouse gases. That’s a noble goal, but Nordhaus’ work has no more helped to defuse the threat of global warming than Neville Chamberlain’s appeasement of Germany prevented World War II. Rather, Nordhaus’ low-ball estimates of the costs of future climate change and high-ball estimates of the costs of containing the threat contributed to a lost decade in the fight against climate change, lending intellectual legitimacy to denial and delay.

Unfortunately, the LA Times missed the nugget in the racket

At any time t, the present value (PVt) of future climate change – or, in plain words, the cost to society if it were to bear the brunt of climate change at time t rather than in the future – involves two separate considerations: (1) the estimated cost to be incurred n periods into the future (Ct+n), and (2) the discount rate at which these costs are to be brought back to present value (r). The simplified formula of this computation is short and elegant:

PVt = Ct+n / (1+r)n

As it turns out, the LA Times piece focused on only one of these two components – the costs (Ct+n), and how Nordhaus belabored to underestimate them – while saying nothing about the discount rate (r). The reason for this omission is simple: everyone can relate to images of rising seas, intensifying storms and harrowing droughts, but few understand – let alone care about – accounting symbols and computations. This omission, though, is highly unfortunate, because it is precisely these accounting symbols and computations that the Nordhaus racket relies on most.

Fiddling with the discount rate

To illustrate, consider the following example. Suppose Nordhaus wants to cut the estimated PVt of climate change costs incurred 100 years from now by 50% below the scientific consensus. One way of doing so is to convince his readers that, 100 years from now, Ct+n will be half as large as most scientists think. But that won’t be easy. After all, Nordhaus is no climate scientist, he is a mere economist, and it would be a tall order, even for a future Economics Nobel Laureate, to argue that the climatological consensus is 50% off the mark.

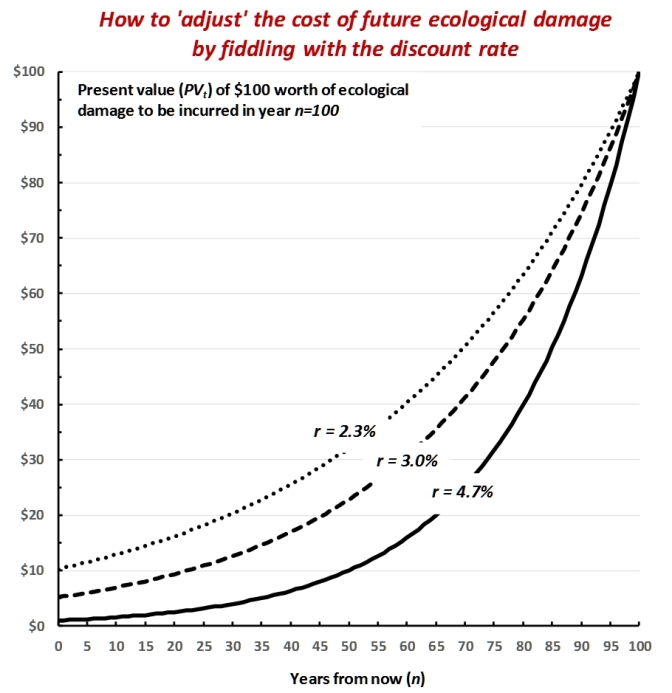

But there is a much easier route, and that is to fiddle with the discount rate (r). The enclosed chart shows how the same $100 worth of climate damage incurred 100 years from now (rightmost point on the horizontal axis, where n=100) changes as we get closer to the present (leftmost point, where n=0). Each line shows the changing present value under a different discount rate, with lower/higher discount rates causing smaller/greater reductions in present value.

Now, suppose the conventional discount rate is 2.3% (dotted series). With this discount rate, today’s present value (PV0) of $100 worth of climate cost incurred one hundred years from now (n=100) is approximately $10. But there is nothing to prevent Nordhaus from using a different rate. A slightly higher rate of 3% (dashed series), for example, will cause today’s present value to drop by one half, to a mere $5, give or take. And Nordhaus doesn’t have to stop there. He can go the Full Monty, push the discount rate up to 4.7% (solid series), and reduce the present value to a paltry $1. Blessed are the wonders of compound interest.

The nice thing about these discount-rate ‘adjustments’ is that, unlike the commotion stirred by debates over the actual cost of climate change, here there are no messy quarrels with scientists, no raised eyebrows from journalists and no outcries from the cheated public. Only contented politicians and delighted capitalists.

And that is exactly the route chosen by William D. Nordhaus.

Leveraging the capitalization ritual

In his 2007 ‘Review of the Stern Review on the Economics of Climate Change’, he mocked Lord Nicolas Stern’s assumption of a low discount rate of 1.4%, suggesting we should instead discount the future by his favourite rate of 6%.

And that mockery succeeded wonderfully. By leveraging the capitalization ritual in the name of profit and glory, Nordhaus managed to not only help investors minimize the apparent cost of climate change, but also win the Economics Nobel Prize as the white knight of nothing less than . . . ‘sustainable global economic growth’! Who says you can’t eat your cake and have it too?

A decade ago, we summarized the Nordhaus racket as follows:

The future of humanity

The all-encompassing role of discounting is most vividly illustrated by recent discussion of environmental change. One key issue is the process of global warming/dimming and what humanity should do about it. Supporters of immediate drastic action, such as Nicholas Stern, argue that there is no time to waste. According to The Economics of Climate Change (2007), the report produced by a review panel that he headed for the British Government, the world should invest heavily in trying to limit climate change: the cost of inaction could amount to a permanent 5–20 per cent reduction in global GDP (p. xv). But this conclusion is by no means obvious. Critics such as William Nordhaus (2007) argue against drastic actions. In their view, the overall cost of climate change may end up being negligible and the investment to avert it a colossal blunder.

The interesting thing about this debate – apart from the fact that it may affect the future of humanity – is that both sides base their argument on the very same model: capitalization. Climate change is likely to have multiple effects – some positive, most negative – and the question is how to discount them to their net present value. Part of the disagreement concerns the eventual consequences and how they should be priced relative to each other and in relation to other social outcomes. But the most heated debate rages over the discount rate. At what rate of return should the damage be capitalized?

One thousand dollars’ worth of environmental damage a hundred years from now, when discounted at 1.4 per cent, has a present value of –$249 (negative since we measure cost). This is the discount rate that led Stern to conclude that climate change would be enormously harmful, and that urgent action was needed. But the same one thousand dollars’ worth of damage, discounted at 6 per cent, has a present value of only –$3. This is the long-term discount rate that Nordhaus likes to use in his computations. It implies that the impact of climate change may end up being minimal, and so should the response be, at least for now.

(Nitzan and Bichler, Capital as Power: A Study of Order and Creorder, 2009, pp. 164-5).

If there is a civilizational lesson from this fiasco – assuming we still have time for such lessons – it is that we need to bar the capitalized fantasy of never-ending growth from any discussion regarding the ecological future of humanity.

Recent Comments