Firming Up Hierarchy

Fix, Blair.

(2022).

Economics from the Top Down. 19 November. pp. 1-42.

(Article - Magazine; English).

![[thumbnail of 20221119_fix_firming_up_hierarchy_font.jpg]](/751/1.hassmallThumbnailVersion/20221119_fix_firming_up_hierarchy_font.jpg)  Preview |

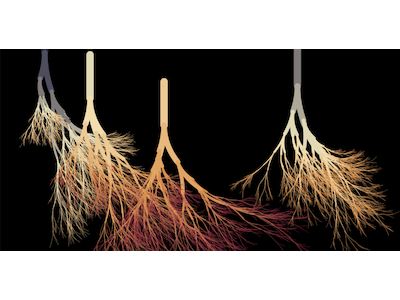

Cover Image

20221119_fix_firming_up_hierarchy_font.jpg Download (541kB) | Preview |

Preview |

PDF (Full Text)

20221119_fix_firming_up_hierarchy.pdf Download (1MB) | Preview |

|

Other (Full Text -- EPUB)

20221119_fix_firming_up_hierarchy.epub Download (9MB) |

Alternative Locations

https://economicsfromthetopdown.com/2022/11/19/firming-up-hierarchy/, https://www.econstor.eu/handle/10419/270943

Abstract or Brief Description

If an unmarked package arrived at your door, how would you figure out what was inside? The catch is that you cannot open it.

As a social scientist, I deal with this ‘black-box’ problem all the time. I (metaphorically) watch people go to work at firms. And I see them come home with income. Then I try to picture the ‘machine’ that gave people money.

In my mind’s eye, I see a machine called hierarchy.

Inside each firm, I imagine a corporate hierarchy that sorts workers into a chain of command and assigns them income based on their rank. Or in more personal terms, when people go to work they have a boss. And their boss makes more money than them.

In a colloquial sense, we all know that this is how firms work, because we’ve experienced it as workers. In other words, as individuals, we get an ants-eye view of the corporate hierarchy. But what we can’t do is play god and study corporate hierarchy by cutting the ant’s nest in half. Corporations tend to dislike that.

And so as scientists, we’re left with a black-box problem. If we want to study how hierarchy affects income, we have to do it without opening the corporate box. Our only option is to ‘stand’ outside firms and watch what goes in and out. Then we see if these observations are consistent with what we think goes on inside.

Speaking of observations from firms, in this post, I unpack data from a landmark 2019 paper called ‘Firming up inequality’. In that article, economists Jae Song and colleagues use data from the Social Security Administration to reconstruct the income distribution within US firms from 1981 to 2013. Their results are a goldmine for studying the hierarchical pay structure within firms.

Using Song’s data, here’s the idea that I’m going to test. I think that the recent rise in US income inequality is being driven by a redistribution of income within firms. In short, I believe that corporate hierarchies have become more despotic. Corporate elites have taken income that once went to the bottom of the hierarchy and redirected it to the top.

To test this idea, we’ll take a meandering route. First, I’ll tell you about my model of corporate hierarchy and how it explains income as a function of ‘hierarchical power’. Then I’ll give you a tour of US income inequality, and show you why it’s plausible that the recent rise in top incomes is being driven by growing ‘hierarchical despotism’. Next, I’ll break out the math and build a model of the US corporate landscape. I’ll use this model to predict the redistribution of income within US firms. Finally, I’ll compare the model’s predictions to the real-world trends reported by Song and colleagues. If all goes well, we’ll get some insight into the machinations of US corporate hierarchy.

My results? I find that to a surprising extent, the redistribution of income within US firms can be explained by a single parameter — a change in the rate that income scales with hierarchical power.

Language

EnglishPublication Type

Article - MagazineKeywords

hierarchy income distributionSubject

BN Money & FinanceBN Power

BN Business Enterprise

BN Capital & Accumulation

BN Conflict & Violence

BN Distribution

BN Industrial Organization

BN Institutions

Depositing User

Jonathan NitzanDate Deposited

20 Nov 2022 21:59Last Modified

22 May 2023 12:57URL:

https://bnarchives.net/id/eprint/751Actions (login required)

|

View Item |